MEGARA Newsletter Issue 14 | Q2 | 2023

Date

VERMEG is Exhibiting at the SIBOS 2023 in Toronto

VERMEG team is excited to be part of the SIBOS 2023 as an exhibitor, in the Metro Toronto Convention Centre from the 18th to the 21st of September.

The conference is a must attend event in the finance and collateral management landscape, where the most important issues facing the financial industry will be debated and addressed.

Visit our booth N° K30, to discuss with our teams the latest Technology in Collateral Management, and discover VERMEG’s MEGARA© solution, our comprehensive & modular Suite covering Post-Trade processing.

MEGAFees: flexibility, transparency and better optimization of fee management

Institutional fee and billing management is a critical aspect of the custody industry. Recognizing the industry’s shift towards a fee-based model, we are pleased to introduce MEGAFees—a robust module designed to streamline and optimize fee management for institutional clients.

MEGAFees is a comprehensive standalone module specifically developed to centralize fee and billing operations. By consolidating these processes into a single platform, MEGAFees offers institutional clients improved control and transparency over their fee structures, leading to enhanced operational efficiency.

With MEGAFees, institutions centralize the definition and calculation of the various fees and billing rules across multiple activities, such as corporate actions, settlements, safekeeping, and cash management. This module allows for personalized fee structures that align with the unique requirements of each institution.

MEGAFees also enhances transparency by providing a clear view of customer pricing tables, ensuring clients have a comprehensive understanding of their fee breakdown.

Additionally, MEGAFees seamlessly integrates with client or external systems, facilitating the consolidation of fees generated and calculated in other platforms into a unified invoice.

As a leading provider to the custody industry VERMEG continuously strive to deliver solutions that address the evolving needs of our institutional clients.

Feel free to contact VERMEG’s Representatives for more information.

Buy-IN : Manage SDR Process More Efficiently

MEGARA© has recently introduced a new feature to assist custodians in managing the Buy-IN process more effectively. Under SDR regulations custodians face challenges in efficiently handling Buy-INs. While the Buy-IN itself is now regulated, the reporting process to inform the failing party and the Buy-IN agent is more complex.

To address this issue, MEGARA© now offers an additional feature that provides custodians with improved clarity throughout the various Buy-IN steps.

The first step is the Buy-IN initiation, where an email notification called the Buy-IN Initiation Notification is sent to the failing delivery party (FDP) to inform them about the commencement of the Buy-IN process. Once the Buy-IN initiation information is manually included, the user can trigger the sending of an instruction.

During the deferral period, if applicable, the user manually updates the Buy-IN information, including the deferral indicator and deferral date. Subsequently, an email is sent to the FDP, containing a Buy-IN Deferral Notification attached as a PDF file.

Upon the completion of the Buy-IN process, which may involve multiple Buy-INs, the user manually includes the relevant Buy-IN details within the failed settlement instruction.

Overall, MEGARA©’s newly introduced feature aims to simplify the Buy-IN process for custodians by providing clear notifications and instructions at each stage.

By offering enhanced functionality, custodians can effectively manage Buy-INs and ensure smooth operations without the complexities associated with reporting.

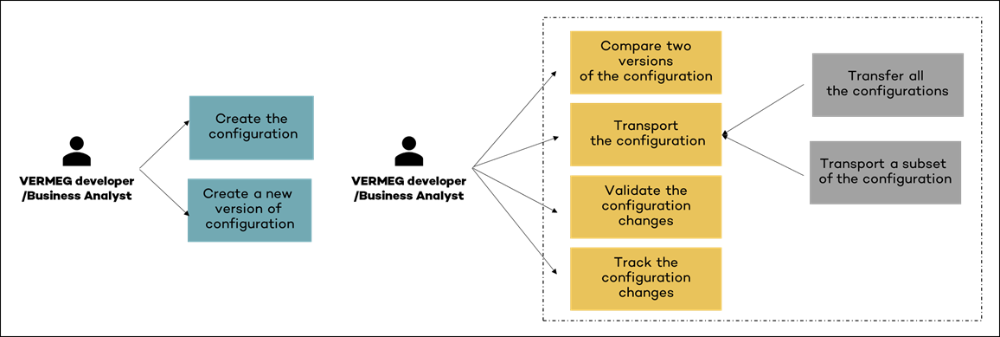

MEGARA Migration Toolkit

To assist VERMEG clients in their production support and change management process VERMEG has invested in a migration toolkit which normalizes configuration requirements across all client environments. The next stage will be the roll out to the VERMEG support team who will use this function to more efficiently support our clients.

Our objective is to normalize each process using a tool to allow for simplified transfer of configurations from one environment to any other environment.

VERMEG Exhibited at ISLA 30th Annual Securities Finance & Collateral Management Conference

VERMEG was pleased to be a sponsor of the ISLA 30th Annual Securities Finance & Collateral Management Conference, was held in LISBON on June 20-22, 2023.

Collateral management has been a hot topic among companies at ISLA 30th Annual Securities Finance & Collateral Management Conference in Lisbon. “Firms are challenged and have limited bandwidth to implement new technology, but most recognize that maintaining outdated legacy systems is costly.”

Today, securities lending and financing markets have the capacity and flexibility to look at new trade ideas and provide solutions to the broader challenges associated with liquidity, collateral mobilization, and capital efficiencies across the wider financial markets eco-system.

Reach out to VERMEG team to get more information.

VERMEG was at The Network Forum Annual Meeting – Athens 2023

VERMEG team was thrilled to take part of The Network Forum Annual Meeting 2023 that took place on June 20 – 22 in Athens this year.

Great event, brilliant sessions and panels, focusing on the key areas of growth and challenges that the market faces, and having the best time networking.

This 3-day event highlights hot topics and conversations around all things Post Trade, Digital Asset Custody offerings, Operational Resiliency/Crisis Management and more.

Click here to see the event in review.