Your Trusted Partner for Reporting in North America

VERMEG, formally Lombard Risk, has been a proud solution provider to our North American clients for decades. Our New York-based subject matter experts offer unparalleled expertise in implementation, support, and ongoing development.

Comprehensive Coverage across the NAM region

VERMEG ensures that all reports and calculations can be individually licensed, allowing firms to optimize their solution by selecting only the essentials. This approach guarantees a cost-effective solution tailored to the specific needs of North American financial institutions.

Federal Reserve (FED) and Federal Deposit Insurance Corporation (FDIC) reports include

/ Statement of Condition and Country Exposure

/ Domestic >> FFIEC 031/041/051, FR Y-9C, FFIEC 009/009A

/ Regulatory Capital & Liquidity, Concentration Monitoring

/ Regulatory Capital >> FFIEC 101

/ Market Risk >> FFIEC 102

/ Liquidity and Counterparty Credit >> FR 2052a & FR 2590

/ Capital Assessment and Stress Testing >> FR Y-14A/Q/M

/ US Treasury & Bureau of Economic Analysis reports include:

/ Monthly & Quarterly >> Form B, C, D, & SLT

/ Annual & Benchmark >> SHC/SHLA

/ Foreign & Domestic Direct Investment >> BE-12/15, BE 577, etc.

/ Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) include:

/ Broker-Dealer >> FOCUS P2, SSOI, SIS, etc.

/ Swap dealer/Participant >> FR-CSE-BHC

/ State Banking including:

/ California, Connecticut, New York, & Florida … etc.

In addition, we are also pleased to provide coverage of

/ Cayman Island Monetary Authority reports including

/ Quarterly Prudential Return

/ Locational Survey, Portfolio Investment Survey

/ Domestic Banking Activities

/ Canadian Office of the Superintendent of Financial Institutions (OSFI) reports including

/ Balance Sheet and Income Statement >> M4, K4, P3, etc.

/ Interest Rate Risk >> I3

/ Basel Capital Adequacy Reporting

/ Bank of Canada reports including

/ Collateral & Pledging Report >> H4

/ Geographic Assets and Liabilities Booked In and Outside Canada >> GQ/GR

/ Securities and New Lending, etc.

Don’t see your region or reports?

The adaptability of our AGILE Suite means you’re always ahead, no matter the region or report.

Contact us to understand how we can leverage our technology to rapidly develop new reports or calculations.

Our Best in Class Regulatory Reporting Solution

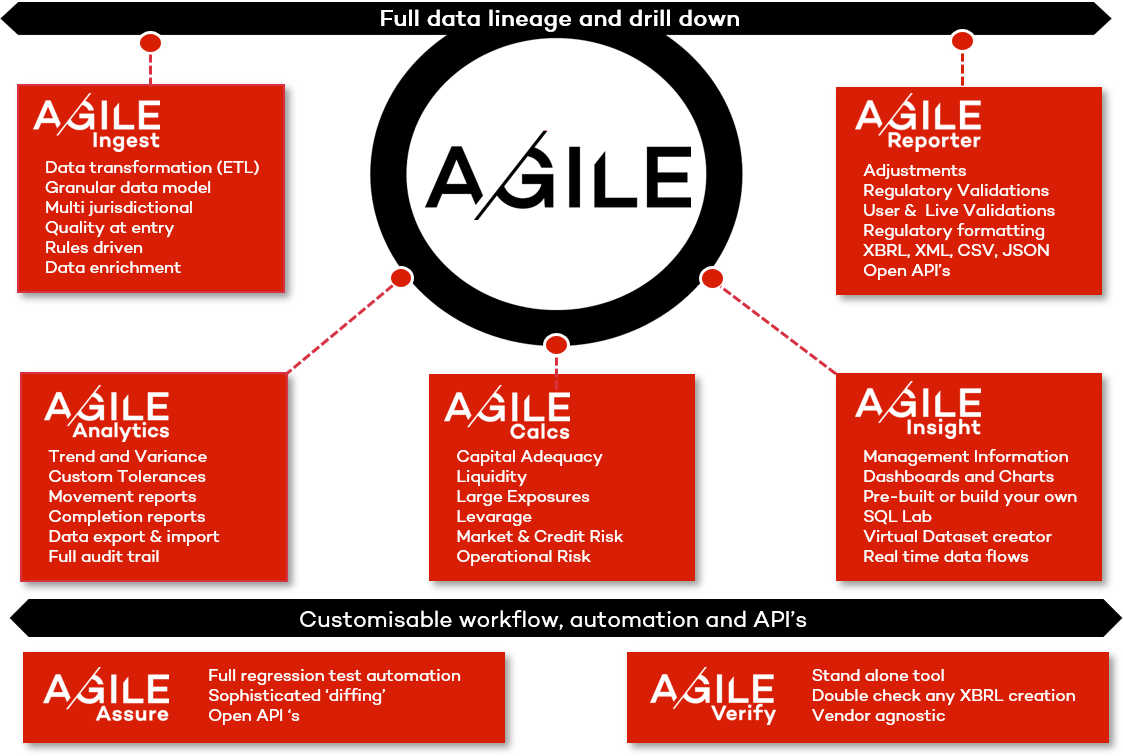

Explore our AGILE Modules

Augment AGILE’s core with powerful add-ons for data integration, calculations, test automation and data analysis.

Download Basel Reforms Whitepaper

Basel Standards for capital adequacy have been around since 1988, increasing in complexity and scope ever since.

This whitepaper recaps the genesis and key objectives of the Basel reforms, explores what the key changes are and the current status of implementation around the world.

Download the Whitepaper

Optimizing Reporting Costs in North America

VERMEG’s AGILE Suite brings cost-efficiency to the forefront of regulatory reporting in North America. By allowing firms to license only the necessary reports and calculations, we help reduce overhead and enhance operational efficiency without compromising on compliance.

AGILE Solutions for North American Regulations

In the fast-evolving regulatory landscape of North America, staying ahead demands agility and precision. VERMEG s Agile Suite is at the forefront of technological innovation, designed to swiftly adapt to new and changing regulations. Our proprietary accelerator enables the rapid development of new templates and calculations, ensuring that financial institutions can meet any regulatory requirement with confidence. From the complex liquidity monitoring reports required by FR 2052a to the detailed analysis necessitated by Single Counterparty Credit Limits (FR 2590), VERMEG offers a comprehensive solution that simplifies compliance, enhances reporting accuracy, and optimizes operational efficiency.

Download AGILE Brochure