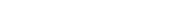

CCPs strive to deliver a full STP collateral management solution for their clearing members to mitigate credit, market, and systemic risk in all markets served.

Extending ownership of collateral eligibility beyond operations and to the member treasury technology deepens member integration within the CCP risk ecosystem.

Ensure your CCP clearing members benefit from the VERMEG best-in-class eligibility monitoring tool, enhanced liquidity management and unparalleled collateral optimisation to interoperate with CCP’s legacy IT infrastructure to achieve maximum collateral management automation.

VERMEG is here to help you meet today’s challenges

/ Lack of modern tools available for a CCP to communicate eligibility requirements directly to Member treasury teams.

/ Increasing cost-of-capital is placing pressure on treasury teams to take ownership of collateral placement as well as liquidity, capital planning and inventory optimization.

/ CCPs and Clearing brokers need to modernize infrastructure allowing their clients more efficient collateral management and optimal allocations simulations.

/ Extension of CCPs memberships to Buy Side and Supras will intensify pressure to provide the right model(s) of technology.

/ Innovative solutions are critical and contribute to markets stability enabling to override future crisis.

VERMEG CCP Clearing Member Collateral Web Portal

Key Benefits

/ Provides Clearing Members access to a comprehensive Collateral Digital dashboard.

/ Real-time visibility of CCP margin excess and deficit across the various account structure and business lines.

/ Streamline collateral deposit, withdrawal & substitution via STP workflows.

/ Reduce operational risk and time-to-react thanks to a modern digital architecture focusing on exceptions management.

To know more about EASY Collateral for CCP download our brochure