SOLIAM Newsletter Issue 8 | Q4 | 2021

Date

Getting ready for the management of FRPS

Easy transfer & management of FRPS portfolios:

The FRPS (Fonds de Retraite Professionelle Suplémentaire), a dedicated vehicle to retirement savings, is gaining a growing number of followers. Indeed, FRPS benefits from less costly prudential rules for insurers, close to the ones that existed before to the Solvency 2 rules.

Several French insurers are transferring more and more additional pensions to these funds. The movement has accelerated with the arrival of the 12/31/2022 deadline that allows them to benefit from these favorable prudential rules.

Transferring portfolios to the SPRF requires significant accounting effort by insurers. SOLIAM provides its clients with a package that allows them to manage the process of transferring assets in order to isolate the accounting scope of the future FRPS and all associated transactions. From 01/01/2022, it is possible to make transactions with accounting entries that distinguish the operations related to the FRPS from the acquisition to the sale or establishment of the company operation. SOLIAM then allows these entries to be exported to the insurer’s general ledger.

SOLIAM 15.1.0 was released on the 31st of December. The newest version of SOLIAM also features ergonomic enhancements for front office screens.

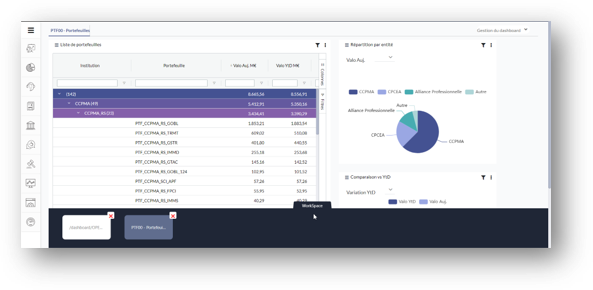

Management of workspace:

In order to simplify the display of screens, we integrated a component to replace the multi-tab function in SOLIAM. This new feature enables users to open several screens while optimizing loading time. Each module is opened in a dedicated card at the bottom of the screen enabling multiple screens to be open at the same time.

Automation of cash transferts linked to liability flows for FID, FIC and FAS funds:

Cash transfer automation was implemented in version 14.1.0 of SOLIAM but only for external funds. In 15.1.0 this feature is extended for other kinds of funds domiciled in Luxembourg such as FID, FIC and FAS. This improvement allows managing cash transfers on accounts based on liability flows by currency and bank account-type.

Improvement of IRR calculation in the Back-office:

The objective of this improvement is to enable the calculation of IRR in the back-office with these options :

1. Modularity of start date, allowing more flexible IRR performance calculation when calculating the periods).

2. To use a valuation of cash flows on the value date.

Upcoming

The upcoming release in March 2022 will offer more features for insurance companies.

⁄ For a Luxembourg company : the management of company box will be more flexible for dedicated transactions.

⁄ For Unit linked : there will be an improvement in corrective order generation, integrating a new category of GAP for corporate actions. The difference report will also be adapted to display more user-defined options.

New update will be available for technical stack :

⁄ The SOLIAM front end will be available with the Angular 11 version.

Download the Newsletter