Risk in Commercial Real Estate Lending

In the “Supervision and Regulation Report,” published in November 2022, (the “Report”), the Federal Reserve noted that banks could be adversely affected by stress in the commercial real estate (“CRE”) sector due to high concentration. The outlook for some CRE properties, the Report indicates, is being affected by changing economic conditions and greater reliance on remote work.

In this blog, we describe how the remote-work culture impacts the CRE sector and what banks—a critical funding source for CRE debt—could do to prepare, and navigate through, the wave of uncertainty.

The Growth of Hybrid Working

An article in Bloomberg cites a study that estimates that lower tenant demand, because of remote work, may cut 28%, or $456 billion, off the value of offices across the U.S. About 10% of that would be in New York City alone (“New York City’s Empty Offices Reveal a Global Property Dilemma – The rise in remote work will hurt older buildings, leaving landlords in the lurch,” Bloomberg, September 2022).

The lack of demand is attributed to the change in work environment. According to International Monetary Fund, trends catalyzed by the pandemic, such as working from home and e-commerce, have an impact on commercial real estate prices. “Increased teleworking, for example, tends to reduce demand for office space, while e-commerce adversely affects the price of retail real estate as consumers shop online. As considerable uncertainty surrounds the future pace and extent of such structural shifts, tighter financial conditions could compound these effects and exacerbate downward price pressures in the affected segments.” (“Commercial Real Estate Sector Faces Risks as Financial Conditions Tighten,” IMF, September 2022).

In addition, the same Bloomberg article further explains that there is no easy fix for landlords, who rely on rental income to pay down debt. Some cities are exploring options to turn downtown offices to residential buildings; but such conversions are difficult due to costs and zoning and architectural restrictions. In short, if it turns out that office culture has permanently moved away from a five-day-a-week in-person model, then there will be more losses to come in the commercial real estate sector.

Risk-Return Relationship

Despite the dismal outlook and while the viability as an investable asset is eroding away due to low demand, CRE loans have continued to grow and the concentration in CRE lending spread amongst 28 percent of insured depository institutions[1] even during the time of the pandemic. The trend can be explained that the banks as lenders have deemed the return in CRE lending worth the risk it poses or that the risk is manageable. In fact, the interest income on loans secured by farmland and nonfarm nonresidential CRE (up $929.4 million, or 10.5 percent) drove the growth in net interest income.[2]

But while the growth in net income, or profitability in general, should no doubt remain the key business objective, banks should also be willing and ready to check whether the risk assumption has taken into consideration the latest development in the sector and determine whether the return, when adjusted for the reassessed risk, does in fact meet the required result. The Federal Reserve, too, stated as much, seeing the increase in past due CRE loans, “the regulators are particularly focused on assessing whether risk management at these banks is commensurate with the level of concentration and the loan composition of a bank’s CRE loan portfolio.”

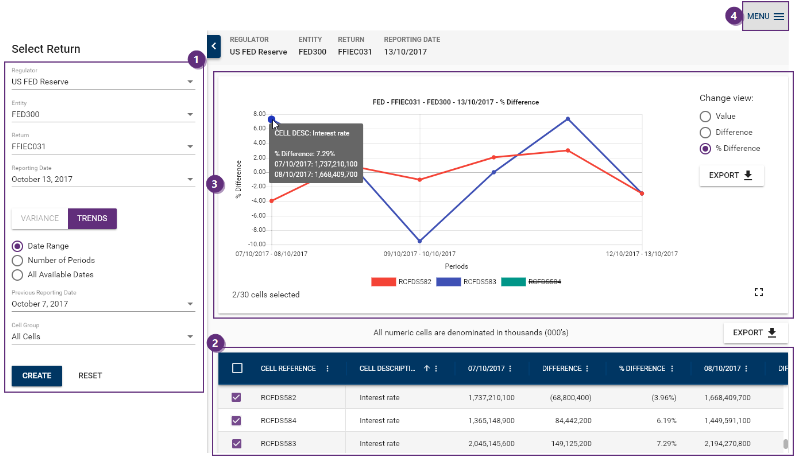

VERMEG can help

To determine a tolerable amount of risk given the expected return requires a careful review of past and current results. It ultimately entails reexamining the risk stance and keeping a watchful eye on the CRE loan portfolio. VERMEG’s Analysis Module is a useful tool in gauging the risk and return relationship. It will help visualize the trend in the loan portfolio and determine whether the level of concentration in the loan portfolio, charted over the trend in interest income, is sustainable, given the capital and provision requirements.

Analysis Module

The full report can be accessed here: https://www.federalreserve.gov/publications/files/202211-supervision-and-regulation-report.pdf

If you are interested in discussing any of the points in this article, or want to find out how VERMEG RegTech solutions can bring agility and competitive advantage to your business, please feel free to reach out to us at communication@vermeg.com or click here.

[1] Supervision and Regulation Report, November 2022

[2] FDIC Quarterly Banking Profile 2nd Quarter 2022

Paul Baik

Regulatory Enablement Manager – North America