Granular Data Reporting Regulations in Asia Pacific

What is Granular Data Reporting (GDR)?

The regulatory compliance space is undergoing a significant transformation globally,

and data granularity is at the forefront of this transformation. Due to the new granular

reporting requirements, financial institutions will be expected to submit transactional/record-level data as granular and disaggregated data sets to regulators, in addition to current aggregated template-based reporting requirements. These data sets are expected to conform to the data models specified by the regulators.

Granular data reporting is referred to using various terminologies across different regions, such as digital regulatory reporting, data model reporting, granular data collections etc.

Benefits of GDR for the regulator and the regulated:

- Regulators across the globe see high-quality granular reporting as a route towards greater transparency and improved techniques to calibrate financial and risk data. This will support improved surveillance, enable better regulatory, macroprudential policy formation for the regulator.

- Data concepts are harmonized and enable better communication between the regulator and industry participants. Granular, disaggregated data sets are expected to be less ambiguous and easier to provide by the financial institutions and enable enhanced compliance. Despite the initial investment required to implement granular data reporting systems, it can ultimately lead to cost savings for both regulators and financial institutions by reducing duplication of reporting efforts, streamlining data collection and analysis, and minimizing the need for manual intervention.

- Standardization of granular data reporting across nations facilitates cross- border data sharing and analysis, providing regulators with a comprehensive view of the global financial system. Also helps in detecting possible causes of systemic risk, such as high levels of exposure concentration or interdependence among institutions, allowing regulators to take precautionary measures to maintain the stability of the financial system.

- Regulators can automate the collection and analysis of data from the reporting entities, reducing the time and resources needed to manage data and allowing for more efficient use of resources. Also reporting institutions will benefit from increased operational efficiency through this automation of data collection and reporting processes.

- Once GDR systems are in production, regulators in the future will be able to perform near-real-time analysis and monitoring of data. This enables regulators to analyse financial data more quickly and accurately, allowing for more informed decision-making and faster responses to emerging risks and threats.

- The availability of detailed and accurate data through granular data reporting enables reporting institutions to make informed strategic and operational decisions, leading to enhanced data-driven decision making. This, in turn, can lead to better risk management by more accurately identifying and measuring risks, leading to better risk mitigation strategies.

Granular Data Reporting Regulations in the APAC region:

The Australian Prudential Regulation Authorities (APRA), 5-year roadmap on the direction of granular data collections (GRC):

In December 2022, APRA has released a response paper addressing issues raised during these consultations and providing more detailed roadmaps (2023 to 2027) for the design and implementation of new granular data collections for each industry. The roadmaps have been refined based on industry feedback, and now specify the reporting standards impacted in each phase, along with an estimated timeline for engagement and consultation.

According to APRA’s communication with the industry, the roadmap for the transformation project is ambitious and will require significant investment from the industry over the next five years. The proposed shift to more granular data collections aims to provide APRA and other stakeholders with deeper insights while also reducing the burden on the industry. Additionally, APRA aims to transition alldata collections to APRA Connect by 2027, allowing for the full decommissioning of the Direct to APRA (D2A) data collection tool.

For more details on APRA’s 5-year roadmap, follow the link: https://www.vermeg.com/blog/apras-5-year-roadmap-on-the-direction-of-granular-data-collections-gdr-and-transition-from-d2a-to-apra-connect/

The Hong Kong Monetary Authorities (HKMA), Granular data reporting (GDR):

Depending on the size of the financial institutions, GDR regulations are made applicable by HKMA in phases.

- 2019-2020 (Pilot phase with selective banks for):

- Residential Mortgage Loans (RML)

- Corporate Loans (CL)

- 2021 (Expansion to cover more reporting banks for):

- Interbank Loans (IBL)

- Debt Securities Held (DSH)

- 2022: (Further expansion to cover more reporting banks for):

- Corporate Loans (CL),

- Interbank Loans (IBL),

- Debt Securities Held (DSH)

The Bank of Thailand’s (BOT), Regulatory Data Transformation program (RDT):

BOT is one of the first regulators to have introduced API submissions for data sets. The Regulatory Data Transformation (RDT) program is a multi-year initiative that is being implemented in stages and is currently ongoing.

- Credit data. Kick-off: Go-Live: Jan’23

- Payment data. Planned Go-Live: Oct’23.

- FX/Derivatives data. Planned Go-Live: Jul’24.

- Securities data. Planned Go-Live: 2024 & beyond.

Other GDR regulations & white papers in APAC:

CBIRC, PBOC, SAFE (China), Reserve Bank of India (India), Bank Indonesia (Indonesia), Bangko Sentral ng Pilipinas (Philippines).

GDR regulations in other jurisdictions:

- European Central bank – AnaCredit.

- Federal Reserve (US) – FRY14, 2502A, 2590.

GDR regulations in other regions:

- European Central bank – AnaCredit.

- Federal Reserve (US) – FRY14, 2502A, 2590.

Considerations for the reporting institutions:

- The data model requirements from regulators are very prescriptive and granular. Reporting entities will have to publish a lot more data points compared to current conventional template-based reporting. Reporting institutions must be ready to address any shortcomings in their upstream or core banking systems to capture the new granular data requirements.

- Reporting institutions should have a robust data governance framework and strong data management capabilities. This includes establishing clear policies and procedures for data ownership, access, quality, and security. A robust data management capability enables efficient data collection, storage, retrieval, and analysis.

- Incorporating granular data reporting may lead to reporting entities having to submit huge volumes of data. Integrating this increased data volume into existing reporting systems can present a significant challenge for reporting institutions. As a result, they may need to consider modifying their systems or investing in new technology to effectively manage and process the increased data volume.

- Reporting institutions must have the appropriate tools and expertise to analyse and report on the granular data effectively. This may involve implementing summary reports, analytics and dashboards that can extract insights and meaning from the data submitted.

- Reporting institutions may require specialized expertise or knowledge that they might not possess in-house. As a result, they may need to consider hiring or providing training to their staff to ensure they can effectively manage the data collection and reporting processes.

- Regulators would like to perform near-real-time analysis and monitoring of data and the frequency of submission for such collections can be much higher than current conventional template-based reporting.

- GDR programs will be implemented in phases. During the initial phases of GDR program implementations by the regulators, the proposed GDR models are likely to keep evolving, and banks should be prepared to cope with the speed/quantity of change.

Future regulatory landscape?

We can expect regulators to collect more and more granular and structured data, with different regulators accepting different paces of adoption. We anticipate these new data-driven reporting requirements to complement existing template-based reporting.

VERMEG capabilities and expertise to help support GDR reporting obligations of the reporting entities:

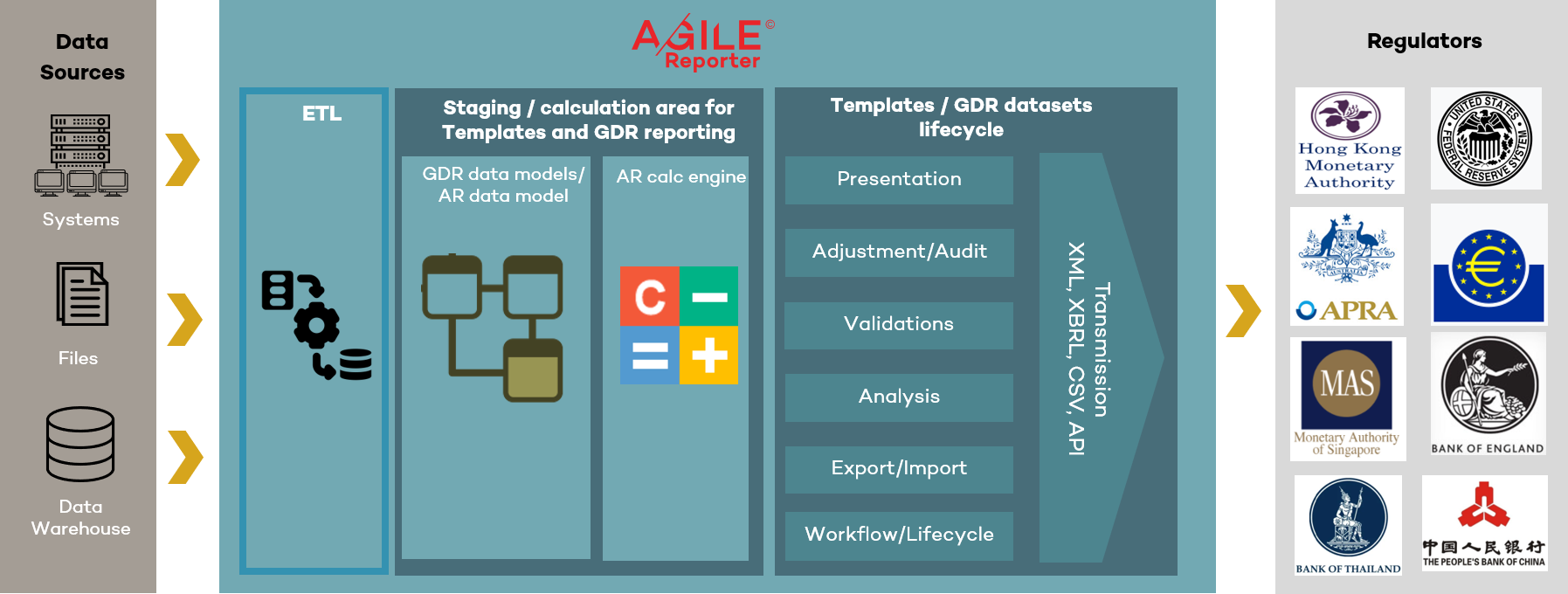

Reporting institutions will benefit from using fully automated reporting solutions, like AGILE Reporter for GDR, that can handle large volumes of data, are flexible, and allow for swift data processing and submissions. VERMEG has extensive experience with successful granular reporting implementations across the globe, such as HKMA GDR, AnaCredit, and Federal Reserve requirements. Therefore, VERMEG is well- positioned to assist reporting institutions in adapting to the evolving GDR requirements across jurisdictions.

VERMEG’s GDR related offerings will help institutions with seamless implementations to meet required GDR compliance, such as:

- Full automation of GDR compliance requirements end-to-end, from banks

source data straight-through automated regulatory transmissions. - Data management capabilities that enable efficient data collection, storage, retrieval, and analysis. Support for data manipulation on the data sets (edits, bulk-edits).

- Automated validations of data sets (regulator defined and user-defined) within data sets, across data sets, across the periods.

- Audit workflows on edits performed on the data sets.

- Approval workflows on data sets (4 eye, 6 eye checks).

- Data lineage across the data sets.

- Meaningful reports for reconciliation purposes.

- Support for delta submissions & period vs. period changes.

- Analytical capabilities on data sets.

- Support for different submission mechanisms, for example, XML, XBRL, CSV, API.

- Cross validations between current template-based reporting and the new GDR data sets.

- Support for both on-premises & managed cloud deployments.

- Usage of big data technologies to support huge volumes of data and fast processing & more…

Pavan Kumar Pothuraju,

Head of Regulatory Product Management APAC