Your trusted partner for UK and EU regulatory reporting

VERMEG, previously Lombard Risk, excels in supporting UK and EU clients.

Our London based subject matter experts and European teams ensure excellence in providing solution implementation, support, and ongoing services for your regulatory reporting needs.

Comprehensive Coverage across the UK and EU

VERMEG ensures that all reports and calculations can be individually licensed, allowing firms to optimize their solution by selecting only the essentials. This approach guarantees a cost-effective solution tailored to the specific needs of UK and EU financial institutions.

Please find below a sample of the reports we cover.

Bank of England (BoE) / Prudential Regulatory Authority (PRA) calculations and reports including

/ Capital Requirement calculations and reports including:

/ Credit Risk, Counterparty Credit Risk, Collateral Optimization, Hedging instruments >> CRSA,CCR

/ Market Risk, including Swaps, Derivatives, Options and Securitizations >> MKIR, MKFX, MKEQ

/ Capital, Leverage Ratios, Group Solvency >> Capital+, LV, GS

/ Liquidity, Additional Metrics >> PRA110, NSFR, ALMM

/ Value Adjustments, Large Exposure (Concentration) Risk, Operational Risk >> CVA, LE, OP

/ Financial Reporting calculations and reports including:

/ Templates for IFRS and GAAP, Asset Encumbrance, Ring-Fence Body Returns >> FINREP, AE, RFB

/ Additional Returns including:

/ Funding plans, Supervisory Benchmarking, and Resolution returns >> P returns, C returns, Z returns

/ Statistical and Legacy Returns

/ All statistical calculations and returns including balance sheet reports >> BT, PL, ELS

/ Pillar 3 Disclosure Reporting (UKCC1, UKKM1, ULLI2, UKOV)

Financial Conduct Authority (FCA) returns include

/ MLAR, RMA and Branch reporting, FCA-CCR, FSA returns >> MLAR, Branch, FSA, CCR, RMA, PSD

/ Investment Firms Prudential Reporting (IFPR) >> IF returns

European Banking Authority Reporting including

/ COREP calculations and reports including:

/ Credit Risk, Credit Risk, Counterparty Credit Risk, Collateral Optimization, Hedging instruments >> CRSA, CRGB, CCR

/ Market Risk including Swaps, Derivatives, Options and Securitizations >> MKIR, MKFX, MKEQ

/ Capital, Leverage Ratios, Group Solvency >> CAR, LV, GS

/ Liquidity, Additional Metrics >> LCR, NSFR, ALMM

/ Value Adjustments, Large Exposure (Concentration) Risk, Operational Risk >> CVA, LE, OP

/ FINREP calculations and reports including:

/ Accounting templates for IFRS and National GAAP, Asset Encumbrance and Ring-Fence Body Returns >> FINREP, AE, RFB

/ Additional Returns such as:

/ Funding plans, Supervisory Benchmarking, and Resolution returns >> P returns, C returns, Z returns

/ Investment Firms Reporting

/ Investment Firm Regulation >> IF returns

/ AnaCredit Reporting

Don’t see your region or reports?

Our AGILE Suite adaptability means you’re always ahead, no matter the region or report.

Contact us to understand how we can leverage our technology to rapidly develop new reports or calculations.

Our Best in Class Regulatory Reporting Solution

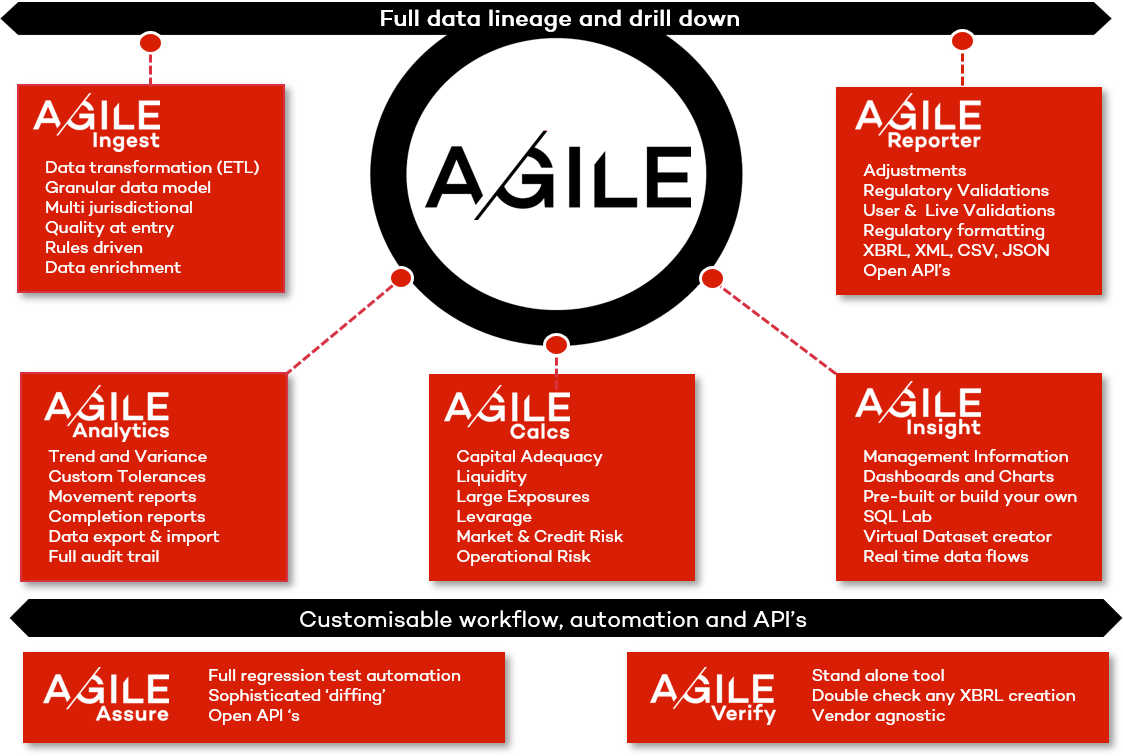

Explore our AGILE Modules

Augment AGILE’s core with powerful add-ons for data integration, calculations, test automation and data analysis.

Download Basel Reforms Whitepaper

Basel Standards for capital adequacy have been around since 1988, increasing in complexity and scope ever since.

This whitepaper recaps the genesis and key objectives of the Basel reforms, explores what the key changes are and the current status of implementation around the world.

Download the Whitepaper

Reducing Reporting Costs Across Europe

Embrace cost-effective regulatory reporting with VERMEG’s AGILE Suite.

Tailored solutions ensure you only pay for what you need, significantly lowering operational expenses.

Explore how we can optimize your reporting processes.

Download AGILE Brochure