Your trusted partner for reporting across Asia Pacific

For decades, VERMEG (previously Lombard Risk) has supported clients across Southeast Asia, North Asia, and Oceania.

With locally based teams in Hong Kong, Singapore, and Sydney, we provide dedicated regulatory subject matter experts for comprehensive implementation, support, and development services.

Comprehensive Coverage aross the APAC region

VERMEG ensures that all reports and calculations can be individually licensed, allowing firms to optimize their solution by selecting only the essentials. This approach guarantees a cost-effective solution tailored to the specific needs of APAC financial institutions.

Please find below a sample of the reports we cover.

Monetary Authority Singapore reports including

/ Core reports such as:

/ Main balance sheet & related detailed reporting, Interest rate repricing, Credit grading & provisions, Derivatives Turnover, Statistics >> MAS610 suite of returns

/ Liquidity Requirements >> MAS649, Minimum cash balance (MCB), Asset maintenance ratio (AMR)

/ Top exposures reporting >> TBGS (Top borrower group survey including Top Non-Bank, Bank exposure reporting, Collateral, Credit risk)

/ FX transaction reporting >> MAS755

/ International banking statistics >> FC/FD

/ Income and Expenses return >> QIE

/ Exposures and Credit Facilities to Related parties >> MAS643A

/ Depositors Insurance >> DIA

/ Other reports such as:

/ Lending of SGD to Non-Resident Financial Institutions >> MAS757

/ Quarterly Report on Loans secured by Real Estate >> Section 35

/ Private Equity and Venture Capital Investments >> MAS630

/ Quarterly Statement of Credit Card/Charge Card facilities >> MAS759

/ Collection Of Statistical Returns for Unsecured Credit Facilities >> MAS760

/ Other reports…

Hong Kong Monetary Authority reports including

/ Core reports such as:

/ Main Balance sheet & related detailed reporting >> MA(BS)1, 1A, 1B, 1H, 2A, 16, 17, 20

/ Liquidity maintenance requirements >> MA(BS)1E, 18, 22, 23

/ Capital Adequacy and risk reporting >> MA(BS)3, MA(BS)25, MA(BS)27

/ Large exposures reporting >> MA(BS)28

/ Interest rate risk in banking book >> MA(BS)12, MA(BS)12A, MA(BS)12B

/ International banking statistics >> MA(BS)21A, MA(BS)21B

/ Income and expenses >> MA(BS)1C

/ Surveys and other reports >>Around 20 surveys applicable across various type of banks

/ Other reports such as:

/ FX Position >> MA(BS)6

/ Return of Hong Kong Dollar Interbank Transactions >> MA(BS)11

/ Mandatory Provident Fund Related Activities >> MA(BS)13

/ Return of Securities Related Activities >> MA(BS)14

/ Insurance Related Activities >> MA(BS)15

/ Certificate Of Compliance >> MA(BS)1F

/ Assessment of Systemically Important Authorized Institutions >> MA(BS)24

Hong Kong Deposit Protection Board reports include

/ Return of Relevant Deposits >> DPB

Australian Prudential Regulation Authority (APRA) reports including

/ Core reports such as:

/ Main Balance sheet and related reporting >> EFS Collection i.e., ARF 720, ARF 740 series

/ Liquidity maintenance requirements >> ARF 210 series

/ Capital Adequacy and Risk reporting >> ARF 110, ARF111, ARF112, ARF113, ARF114, ARF115, ARF116, ARF118, ARF120

/ Exposures reporting >> ARF 221, ARF222, ARF223, ARF230

/ Provisions reporting >> ARF 220

/ Interest rate risk in banking book >> ARF 117 series

/ International banking statistics >> ARF 731 series

/ Income and expenses >> ARF 730 series, ARF 330 series

/ Other reporting includes

/ Points of Presence – Face-to-Face Service Channels >> ARF_796_1

/ Points of Presence – ATMs >> ARF_796_2

/ Points of Presence – EFTPOS Terminals >> ARF_796_3

/ Financial Claims Scheme Data Collection >> ARF_910_0

/ ABS Form 90 Australian Bureau of Statistics Survey of International Investment >> Form_90

/ Other reports…

Reserve Bank India reporting including

/ Statistical Reporting including

/ Basic statistical reporting >> BSRI, BSRII, BSRIII

/ Card Statistics >> CUSTAT and PCSSTAT

/ Liquidity and Leverage Reporting including

/ Liquidity Returns >> LR, LCRBLR

/ Statutory Liquidity Ratio and Requirements >> SLR, SLR2

/ Leverage Ratio >> LEVRATIO

/ Asset and Liability Reporting

/ Asset Liability and off-Balance Sheet Exposures >> DSBIALE

/ Liabilities and Assets in India >> FORMX

/ Asset Quality >> RAQ

/ Risk and Capital Reporting including

/ Risk based supervision >> RBSTR1, RBSTR2, RBSTR3, RBSIXBRL

/ Capital adequacy >> RCAIII

/ Large Credits >> RLC

Don’t see your region or reports?

The adaptability of our AGILE Suite means you’re always ahead, no matter the region or report.

Contact us to understand how we can leverage our technology to rapidly develop new reports or calculations.

Our Best in Class Regulatory Solution

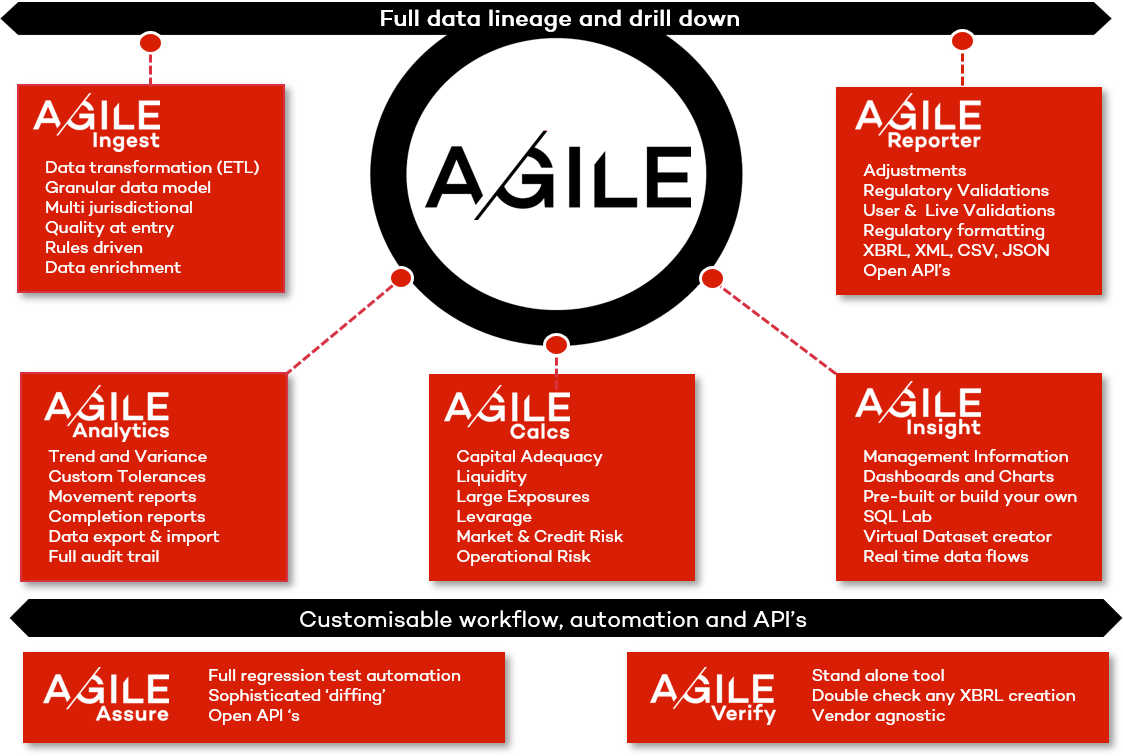

Explore our AGILE Modules

Augment AGILE’s core with powerful add-ons for data integration, calculations, test automation and data analysis.

Download Basel Reforms Whitepaper

Basel Standards for capital adequacy have been around since 1988, increasing in complexity and scope ever since.

This whitepaper recaps the genesis and key objectives of the Basel reforms, explores what the key changes are and the current status of implementation around the world.

Download the Whitepaper

Reducing Reporting Costs Across APAC

Embrace cost-effective regulatory reporting with VERMEG’s AGILE Suite. Tailored solutions ensure you only pay for what you need, significantly lowering operational expenses.

Explore how we can optimize your reporting processes.

Singapore

The leading solution for MAS reporting among Singapore’s banks.

Discover how we can support your compliance needs.

Hong Kong

Offering comprehensive support for HKMAs new GDR regulations, catering to both foreign and locally incorporated banks.

Australia

Complete support for APRA reporting, including EFS, Granular Collection Scheme reports, and APRA Connect integration.

Leading in Granular Data Reporting

Asia leads in the adoption of granular data collections. VERMEG’s FCR engine reimagines regulatory reporting with a highly scalable platform, ensuring responsiveness over massive data sets.

Download AGILE Brochure