Deposit Concentration: what are Banks to do?

Deposit Concentration Risk

There is a post-mortem: if it had not been for bank runs, the banks that recently have been taken over by the regulators would have been able to survive, despite the shaky balance sheets showing assets rapidly losing values. There is no doubt bank runs are a difficult problem to overcome. In the recent cases, once the panic set in, driven by the fear that the deposits weren’t safe, these institutions were swiftly shuttered to prevent the crisis from becoming a contagion. One of the factors that led to, or exacerbated, the bank runs was deposit concentration, the one that subjects deposit taking institutions to withdrawal risk, which then threatens the stability of the banking industry.

In the study that investigated the degree and implications of deposit concentration at Norwegian financial intermediaries, the author, Ragnar E. Juelsrud, concluded that «In fact, looking at the aggregate level, the top quartile of depositors according to deposit size in 2018 accounts for 92% of total deposits. The top 5% accounts for 53.1% of total deposits… Overall, financial intermediaries are subject to substantial idiosyncratic deposit withdrawal risk[1].»

FDIC also identifies the risks associated with large depositors and deposit concentration. It defines that a large depositor is a customer or entity that owns or controls 2% or more of the bank’s total deposits and states in the examination policy, «Some large deposits remain relatively stable over long periods. However, due to the effect the loss of a large deposit account could have on an institution’s overall funding position, these deposits are considered to be potentially less stable liabilities.» (Risk Management Supervision – Liquidity and Funds Management, FDIC)

What are Banks to do?

If deposit concentration is a grave risk and withdrawals by a small number of depositors portend a potential bank run, what are banks to do? After all, while the banks may understand the risk, banks will not stop customers, big or small, from opening accounts with them. In doing so, they find themselves soon enough precariously exposed to the risk.

Though imperfect, there are ways, however, to diversify depositor base and ease the concentration. For example, deposit insurance can help alleviate the concentration risk, because deposit insurers encourage a more diverse depositor base. Mid-sized banks after recent banking crisis even suggested that FDIC insure all deposits, since depositors’ moving to larger banks for safety would mean an eventual loss of funding for mid-size banks and adverse impact on the regional economy.

Banks also can try to make a withdrawal more difficult. FDIC indicates, «Large deposits might be more stable if the deposit is difficult to move (e.g., the deposit is in a transaction account used by a payroll provider), if the depositor is an insider in the institution, or if the depositor has a long history with the institution.»

Banks could also consider offering deposits that are geared towards meeting the needs of sectors that are different than the current depositors, e.g., more retail vs. institutional.

These are not sure remedies, though. For example, the call for insuring all deposits was immediately met by a warning that the government’s guarantees would lead to excessive risk-taking, i.e., that it would lead to a moral hazard.

In terms of establishing a long history, FDIC also warns that regardless of such past relationship, depositors may withdraw funds during stress periods regardless of difficulties or the effect on the bank, which was exactly what happened during the recent banking crisis.

In terms of increasing the number of depositors, the same Norwegian study found that a larger number of depositors does a little to alleviate the risk, if the volume of deposits are concentrated at a few depositors.

Given all these, it’s not a single solution or strategy that can help. Rather, a combination of preventive measures taken together can adequately address an issue as intractable as deposit concentration. Especially, mid-size banks that are limited in terms of resources to enable a wider reach and attract a more diverse set of depositors must be cognizant of the threat and hence, the need for diligent monitoring and risk management.

VERMEG can help

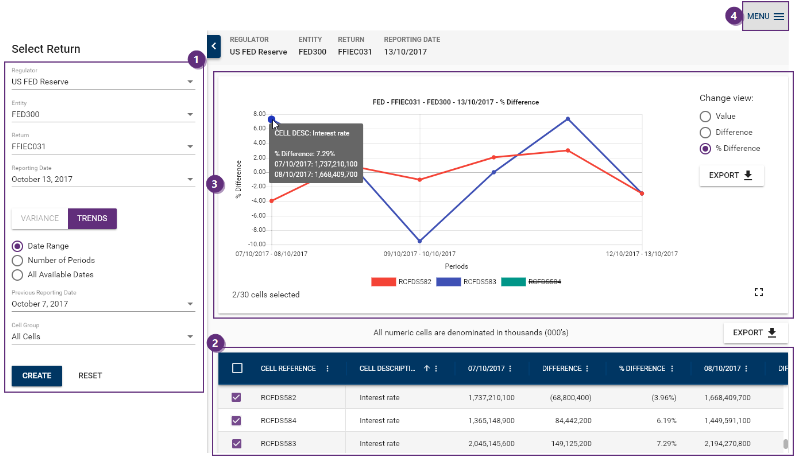

Using the regulatory reporting results in AGILE, VERMEG’s regulatory reporting platform, users can leverage its AGILE Analytics module to continuously monitor and discern a trend, which not only helps anticipate the scrutiny by the regulators but also and more importantly, can inform and alert the concentration risk.

To find out, please visit us at VERMEG Regulatory Reporting.

[1] Deposit concentration at financial intermediaries, Ragnar E. Juelsrud, November 2020

Paul Baik

Regulatory Enablement Manager – North America