SOLIAM provides you with a single Core Solution for real-time overview of your investments.

SOLIAM by Vermeg

SOLIAM provides you with a single Core Solution for real-time overview of your investments.

SOLIAM has two versions:

- SOLIAM for Asset Owners

- SOLIAM for Wealth Managers

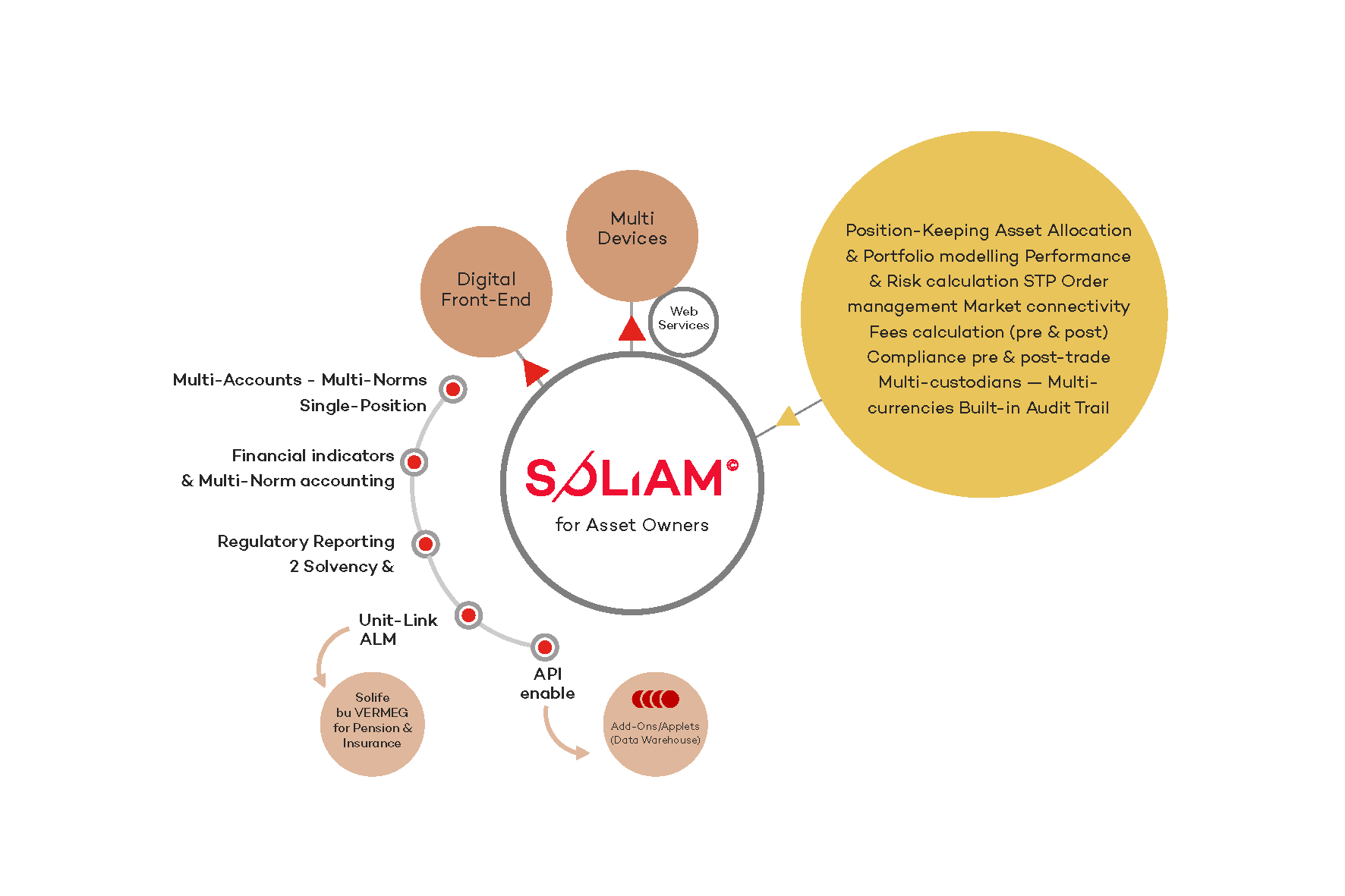

SOLIAM for Asset Owners

- A single core solution for real-time overview of the client’s investments

- A Multi-Custodian and Multi-Account keeping software enabling a comprehensive front-to-middle process management, for wealth managers, private bankers and family offices

- A unique turnkey solution for position-keeping and financial decisions, dedicated to wealth management specific needs: advisory and/or discretionary processes, fiscal allowances (life insurance, equity savings plans, securities accounts etc.), wide selection of financial instruments (UCITS, derivatives, active Equities etc.)

- An up-to-date MIFID II compliant solution

×

![]()

SOLIAM value for Asset Owners

Single integrated platform: reduce your operational risk and increase your operational efficiency

Multiple accounting framework: local and international compliance (IFRS9)

Regulatory compliance: Solvency 2 (SCR computation, QRT reporting, TPT/Ampere reporting)

Unit-Link ALM engine: market orders aggregation and netting, SWIFT message generation, ALM stock reconciliation with automatic order

Adjustments, intermediation, risk reporting

Client stories

SOLIAM for… a Trustworthy Insurer

With 20 BnEUR AuM and over 300,000 end Clients, our Client is a multi-asset investor: his asset allocation covers Equities, Loans, Infrastructure and Real Estate.

His reputation for Corporate Social Responsibility requires consistency and trust in his investment policy.

His reputation for Corporate Social Responsibility requires consistency and trust in his investment policy.

HIS AMBITIONS WERE TO:

- Consolidate several legal entities and accounting plans

- Cut operating costs and escape from a heavy legacy debt

- Become a unique reference feeding all other IT systems

- Upgrade to Solvency II/ IFRS 9 regulatory requirements

- Implement structure for QRT reporting

- Challenge Data providers on Pricing

- Connect to several Partners on shared investment Programs

BENEFITS WERE:

- Drastic reduction of direct IT costs

- Optimization of Back & Middle-Office, both on indirect costs & stronger integration

- QiS Tests 100% OK

- Set Up of a reference Data-Warehouse

- IT coherence with a single view for Investment Management

- Built-in Continuous Regulatory Watch

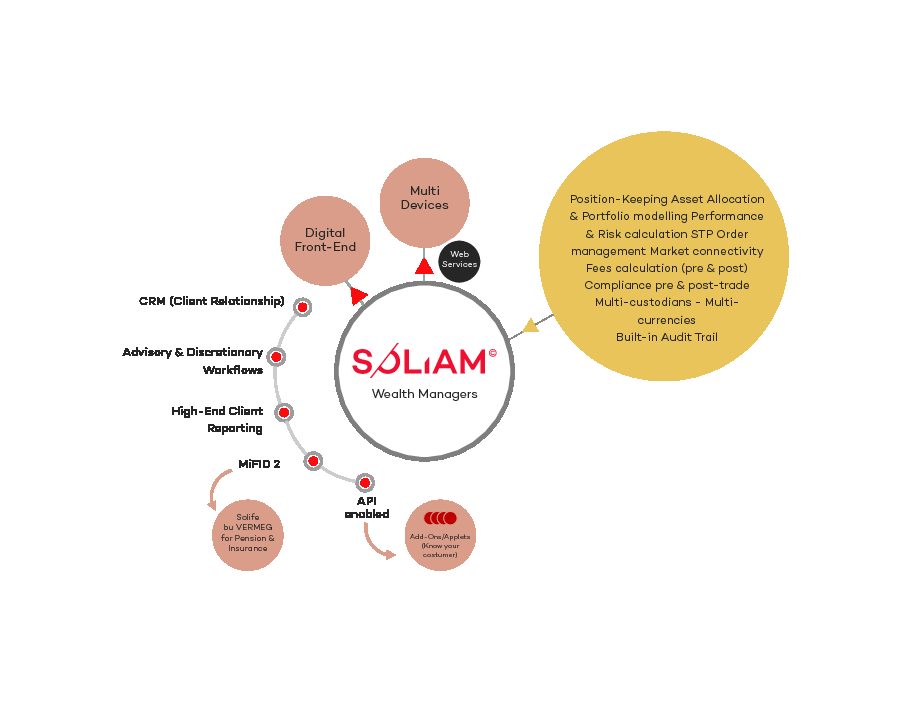

SOLIAM for Wealth Managers

- A single core solution for real-time overview of the client’s investments

- A Multi-Custodian and Multi-Account keeping software enabling a comprehensive front-to-middle process management, for wealth managers, private bankers and family offices

- A unique turnkey solution for position-keeping and financial decisions, dedicated to wealth management specific needs: advisory and/or discretionary processes, fiscal allowances (life insurance, equity savings plans, securities accounts etc.), wide selection of financial instruments (UCITS, derivatives, active Equities etc.)

- An up-to-date MIFID II compliant solution

×

![]()

SOLIAM value for Wealth Managers

Up-to-date MiFID II compliant solution (suitability and appropriateness test, fees computation ex-ante)

Project delivery standard methodology combined with the business expertise of our consultants and the modularity of the solution to reduce implementation project time to the minimum.

Client stories

SOLIAM for… a reputable company

Our Client is a Global Asset Manager, also providing specific services for high net worth individuals, either discretionary or under mandate, with over 10 000 accounts, AuM 1.5 BnEUR, 20 Private bankers.

HIS AMBITIONS WERE TO:

- Deliver real time financial digital reporting to end-users

- Build a robust multi-tenant architecture for all Custodians and Partners

- Get rid of Legacy debt

- Upgrade to MiFID II Regulation

- Recover 100% of historic calculations (20Y depth)

BENEFITS WERE:

- Quick Roll Out

- Evolutivity & scalability

- Continuous Regulatory watch

- One solution to rule them all

- Drastic operational cost cutting

- Best-of- Breed technology