/ SWIFT Release 2021

We are glad to announce you that the lasted release of MEGARA was certified compatible SWIFT application for:

⁄ MEGARA Securities Settlement: a clearing and settlement solution that automates the full lifecycle of securities transactions. It manages a wide variety of transactions types and offers native connectors to major CSDs, custodians and other market infrastructures.

⁄ MEGARA Corporate Actions: a flexible solution designed to relieve the customers from the burdens of managing the complexity and risk inherent to Corporate Actions. This solution offers a full automation of the process and natively embeds the international standards and all Best Practices recommended by the regional Corporate Actions Working Groups.

⁄ MEGARA Collateral Management: a solution automating the processing of collateral for several possible uses and purposes: SBL, liquidity & monetary policy management, etc.. This solution is being used by some major Custodians and Central Banks in Europe and elsewhere.

Designed with state-of-the-art technology, MEGARA© is an award-winning modular suite that is used by key players in the Securities Services industry in five continents.

MEGARA was designed to increase Straight Through Processing, thus allowing customers to focus only on managing exceptions through pre-built comprehensive dashboards.

MEGARA was among the very first products worldwide to be certified by SWIFT since the creation of the SWIFT Certification labels many years ago. More than two decades after, it continues to lead the way and has been awarded this prestigious label each year.

/ Blockchain: a transformation for Custodians is here

For years blockchain technology has been considered a disruptive technology that will completely change the way the financial industry is structured.

Today, the world of cryptocurrency and blockchain is gaining in maturity. A new phenomenon is emerging since investment funds and regulated institutional investors started paying attention to the crypto market. Attracted by the large margins and expansion possibilities for their portfolios, they are looking for custodian services for cryptocurrencies. Therefore, banks and depositaries are today acquiring blockchain startups and partnering with modern service providers in order to be able to afford Crypto Custody Service.

VERMEG can offer this personalized experience and to help our customers be major actors in this asset class. To provide such a hybrid use, we have upgraded MEGARA to connect to blockchain platforms and manage digital custodies and portfolios such as cryptocurrencies, securities or stocks.

/ Automatic consideration of WTRC tax instruction

A new feature required by most fund administrators to configure performance fees of Fund/ Portfolios in MEGARA is now available.

Performance fees are calculated when Fund NAV overperforms compared to its Benchmark.

MEGARA, calculates it by comparing NAV performance to a single Index or Basket of Indexes performance.

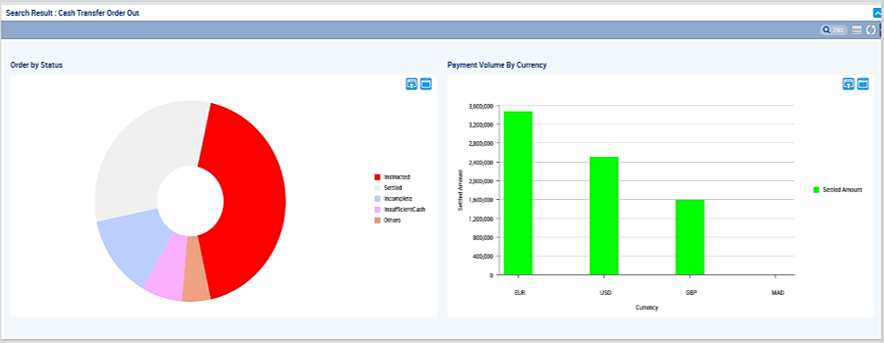

/ New version of MegaCash

A new version of MegaCash is now available. This version is built using the new PALMYRA 21 technology and becomes part of the MEGARA 12 suite.

This version can be used for cash payment and liquidity transfers and supports both MT and MX messaging.