SOLIFE Newsletter Issue 7 | Q3 | 2021

When insurance needs meet the legal requirements

Introduction

As part of VERMEG’s Digital Transformation initiatives, a digital journey of the individual affiliation form has been set up in SOLIFE for group insurance.

VERMEG continues to invest in SOLIFE in order to address evolving maret needs and to fulfil legal requirements and deliver the best solution to its clients.

The “N periods” : a solution to manage disability claims by using calendar view

For claims on disability where benefit type is “Waiver of Premium”, “Annuity” and “Daily Compensation”, the characteristics of disability may evolve over time: throughout the lifetime of the invalidity period, the disability degree and hence waiver (annuity) duration and amount may vary upon multiple factors, for example additional accident or aggravation of existing case, etc.

In most of cases, disability claims are declared to the insurance company several months after the accident occurs. Upon consideration of the claim manager (based on the documents received), the claim period can be split in time where different rates would be applied to different periods.

SOLIFE Feature “N Periods” disability claim”

As part of our continuous improvement, SOLIFE has been upgraded with the feature “N Periods” disability claim” management mode.

Through this new model, a new claim action “Claim Calendar Projection” is available in the claim workflow.

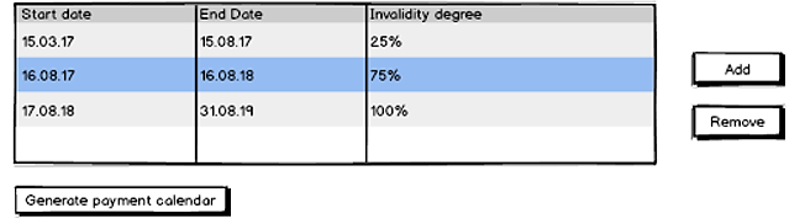

The interface shows :

⁄ The start date : as per calculated Benefit parameter annuity (or waiver);

⁄ The End date : as per calculated Benefit parameter annuity (or waiver);

⁄ The Invalidity degree to be introduced manually.

The claim calendar projection can be updated by adding periods between the start and end dates of the claim and associating the related invalidity degree.

A

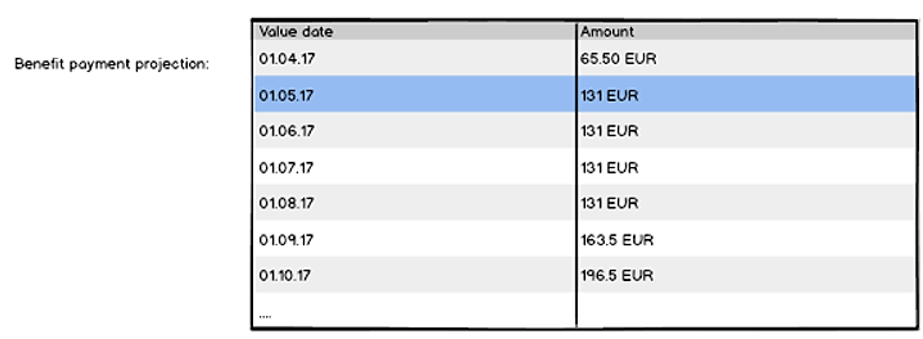

Through the same interface and in addition to the Invalidity calendar, a feature to generate the Payment Calendar is available by pressing a button that returns a simulation of the benefits as per the invalidity calendar, payment schedule, benefit amount calculation rule, retrospective of paid benefits (if any) and recalculation as per the current situation.

“N periods” feature prevents the registration of multiple claim reviews and facilitates the updating of claim data.

SOLIFE : Fulfilling legal requirements – Flashback in Belgium

Partyka is a Belgian law meant to prevent people with significant disease, from paying excessive extra-premium fees for medical reasons, when the insurance is covering a loan for acquisition of unique and proper dwelling.

It is based on a solidarity mechanism in the extra-premium repartition : Extra-premium fees for medical reasons exceeding 125% until 925% are financed automatically for 50% by the insurance company and for 50% by the financial institution providing the loan.

Impact SOLIFE Feature

Partyka law has several impacts on the treatment of the bill and the presentation of the information to the client. These different impacts have been taken into consideration in SOLIFE.

Setup of Partyka applicability base

At a product configuration level, SOLIFE offers the option to define the applicability base of Partyka (coverage by coverage). The portion of medical extra premium, which is between 125% and 925% of the base premium can be defined.

The usage of a Groovy rule allows use of a dated parameter for the definition of these rates, enabling changes in the future.

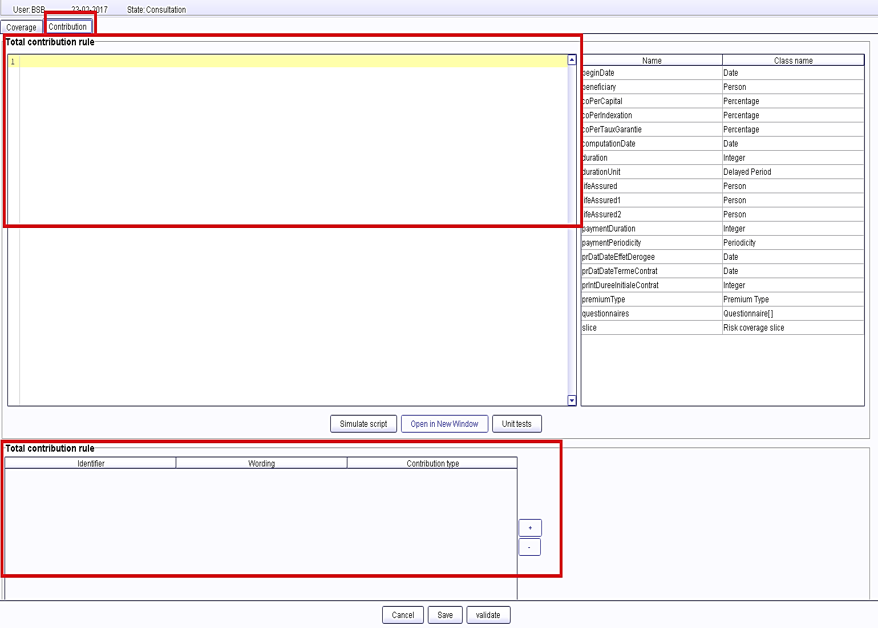

Setup a list of contributors and the corresponding contribution

A list of additional contributors can be created. Rules are available for each contributor in order to setup contributions.

Up to now, the defined contributors are the insurance company itself and the financial institution (bank where the credit is taken), and the rates will be 50% and 50%.

Payment of bills with multi-contributors

When issuing each bill, each additional contribution is calculated and paid automatically.

When un-paying a bill with multiple contributors, only the part corresponding to the payer of the contract is transferred in an instance.

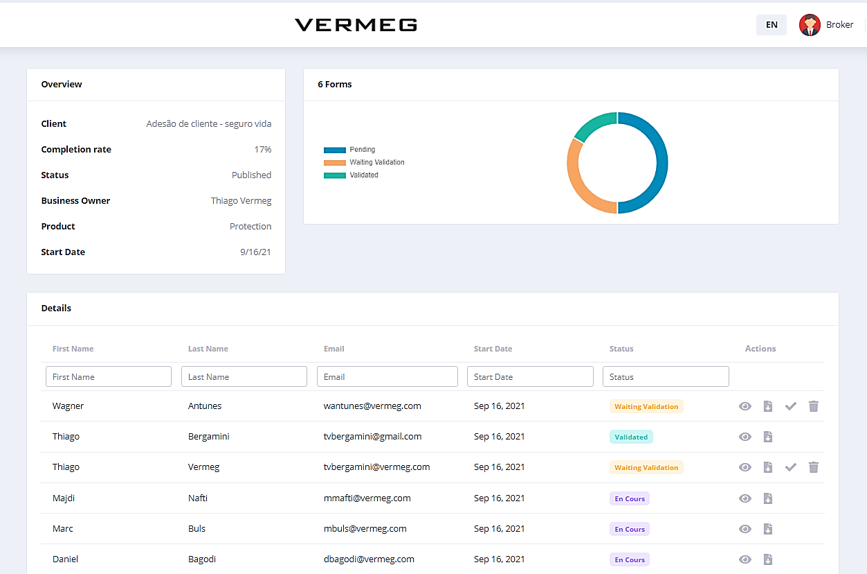

Digital Journey : individual affiliation form

The individual affiliation form for group insurance is now available.

VERMEG continues in the path towards digitalization and the latest step is the digitalization of affiliation forms and sociated processes – a new digital journey.

It is intended for more than one user, and the displayed functionalities depend on the logged user.

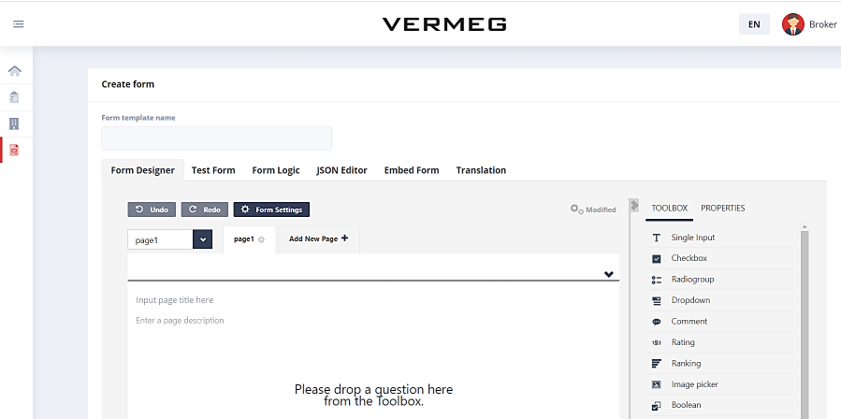

⁄ Creation of an affiliation form:

Forms configuration is intuitive and can be done by the broker. The whole form is customized (fields, logo, colors …).

⁄Creation of

affiliation projects;

⁄A dedicated dashboard for :

- The broker;

- The company.

⁄A separate view for :

- The insured;

- The company;

- The broker.

⁄An electronic signature;

⁄A customization of E-mails;

⁄Double authentication.

In this journey, the broker creates the project with the associated form and insured employees. The employees are notified. They log in to the journey and fill in their affiliation forms. Once done, there is an option to require the company validation. The affiliation form is then sent to the Back Office of the target system.

Individual affiliation form is currently available.