Newsletter AGILE Reporter Issue 9 | Q1 | 2022

Date

VERMEG certified SOC2 Type II

VERMEG has successfully completed a Service Organizations Controls (SOC) 2 Audit Type II examination as part of its continuing commitment to the security of customer data, and achieved an excellent score, with zero deviations reported.

Reaching this milestone is a result of the hard work and involvement of all departments in VERMEG.

SOC 2 audit and certification ensures VERMEG is storing, handling and transmitting while ensuring privacy, security, availability, integrity and confidentiality.

VERMEG FinTalk Podcast

VERMEG launches its FinTalk Podcast having many more detailed conversations to follow with exciting guests in the industry. The Fintalk is is a serieS of podcasts, hosted by VERMEG’s Jawad Akhtar, at the forefront of FinTech pressing topics.

Episode 1: Boosting Investment & Focus on Regulatory Reporting

Win-Win Investment in & Focus on Regulatory Reporting with VERMEG’s James Philips, Regulatory Reporting Strategy advisor.

James & Jawad take a look at the regulatory challenges in the coming year, particularly the transition from OSCA to BEEDS, the latest Dear CEO letter, and overhauling longstanding, outdated processes around data handling.

The episode covers:

⁄ How regulatory reporting needs a similar level of scrutiny to that of financial reporting;

⁄ Resolving data issues through health checks in preparation for regulators’ requirements;

⁄ Using October’s ‘Dear CEO’ letter to focus efforts on key industry issues;

⁄ Key areas we can expect to hear more on throughout this podcast series, particularly around ESG, hybrid workflows and cloud technologies.

⁄ Using October’s ‘Dear CEO’ letter to focus efforts on key industry issues;

Episode 2: The Acceleration of Regulatory Reporting’s Growth

With Vishwas Khanna, & Brain Momoh from Avantage Reply

This episode covers the following topics:

⁄ How the approach to regulatory reporting standards has evolved in recent years, and its current trajectory;

⁄ The process of establishing organisation-wide accountability;

⁄ Being more proactive and accelerating the growth of the reg reporting sector

⁄ Key differences that emphasise the increasing focus on ESG over CSR.

Granular Data Reporting Regulations in Asia Pacific

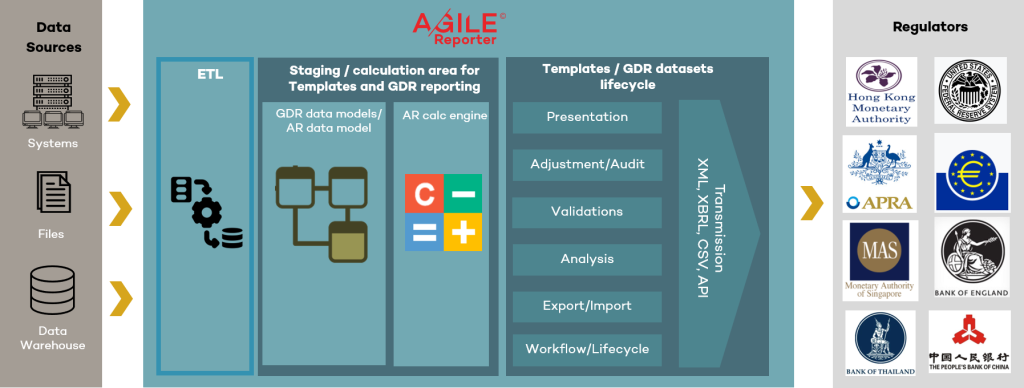

Due to the new GDR (Granular Data Reporting) reporting requirements, banks will be expected to submit transactional/record level data as granular and disaggregated data sets to regulators, supplement current template-based reporting requirements, which are aggregated. These data sets must conform to a data model specified by regulators.

Benefits of GDR for the regulator and the regulated:

⁄ Regulators across the globe see high-quality granular reporting as a route towards greater transparency and improved techniques to calibrate financial data. This will support improved surveillance and regulatory/ macroprudential policy formation for the regulator.

⁄ Data concepts are harmonized and enable better communication between the regulator and industry participants. Granular, disaggregated data sets are expected to be less ambiguous and easier to provide by the banks.

⁄ Reduces the regulatory data burden on the industry by minimizing duplication of data collections and reduces banks’ ad-hoc reporting burden in the long run.

⁄ Once GDR systems are in production, regulators will be able to perform near-real-time analysis and monitoring of data.(using API pull mechanisms etc.)..

VERMEG capabilities and expertise to help support GDR reporting obligations of the reporting entities:

Reporting institutions will benefit from using fully automated reporting solutions, such as AGILE Reporter for GDR, that can handle huge volumes of data, are scalable, and that can enable fast data processing. VERMEG has vast experience with successful GDR implementations globally, for example, for AnaCredit and Federal Reserve requirements, and we are very well positioned to support the banks for evolving GDR requirements across the APAC region.

VERMEG’s GDR capabilities will help banks with seamless implementations to meet required GDR compliance.

North America

FR 2052a

The regulatory agencies in U. S. have finally announced the first submission due date for revised FR 2052a: a two phases approach, May 1, 2022 for entities subject to Net Stable Funding Ratio (“NSFR”) and October 1 for non-NSFR entities. “NSFR” here refers to a new rule, finalized in July 2021, that subjects large banks to maintaining a minimum level of stable funding and the revisions to FR 2052a are designed to accurately reflect the NSFR final rule and to capture other data elements necessary to monitor banking organizations’ liquidity positions and compliance with Liquidity Risk Measurement (LRM) Standards. While the revisions require updates with manifold layers of complexities, VERMEG‘s clients are covered under the license agreement with no additional cost, which is a competitive advantage that VERMEG clients have over other vendors and also a testament to VERMEG’s commitment to the service it provides.

Development of SA-CCR Calculation Procedures

The calculation procedures for Standard Approach for Counterparty Credit Risk, or more commonly referred to “SA-CCR,” have been added to REG-Reporter in its newest version 6.2.3. SA-CCR is a new approach for computing the exposure amount for derivative contracts and is deemed to have addressed the key criticism on the existing method as it more efficiently incorporates the effect of credit risk mitigant. On January 24, 2020, the regulatory agencies finalized the SA-CCR rule and banking institutions are given the option to use SA-CCR to calculate standardized total RWA. REG-Reporter uses the contract level information for derivative transactions and combines the collateral details to arrive at the exposure amount in a simple but fully auditable way as the SA-CCR is intended to be.

United Kingdom

VERMEG’s AGILE Reporter powers Bank North’s regulatory compliance.

Bank North is a new regional business bank which was granted a banking licence (Authorised with Restrictions or ‘AWR’) by the UK’s Prudential Regulation Authority (‘PRA’) in August this year.

The bank operates via seamlessly-integrated, cloud-native banking technology, which powers a network of regional ‘Pods’, where experienced bankers and relationship managers will deliver committed finance to businesses. It will start lending to SMEs later this year with the opening of its first lending ‘Pod’ in Manchester.

Lending services will then be rolled out across the UK. . Working closely with Bank North since 2020, VERMEG has been helping to establish the bank’s reporting processes, so it has robust and thorough systems in place to ensure regulatory compliance. With the implementation of VERMEG’s flagship regulatory reporting product, AGILE Reporter, Bank North is benefiting from an automated, scalable and AWS cloud-based reporting system. The intelligent software ensures the most accurate and efficient reporting possible, and through a user-friendly interface, the finance team is able to manage approvals and workflows, enabling a more efficient finance function and clear oversight for senior management.

News and perspectives 2022

We continue to invest in the future along three strategic axes:

⁄Improving our offering for regulatory jurisdictions that take a granular data philosophy.

VERMEG saw the ‘winds of change’ toward fine-grained dataset regulatory reporting years ago when it embarked on a new cloud-scale regulatory calculation engine: AGILE FCR Calcs. This new module is in use today, supporting Anacredit reporting to the European Central Bank (ECB) and is now leveraged for granular data reporting (GDR) standards emerging in APAC. VERMEG will continue to invest in this area and plans several releases this year to add functionality and create a seamless user experience between regulatory templates and datasets.

⁄Unlocking value from data

Financial institutions have a legal obligation to ensure their regulatory filings are created from the best quality data they can muster. At VERMEG we believe this data contains valuable insights – the same data points regulators are interested in, financial institutions themselves ought to be interested in. Therefore, this year VERMEG will launch AGILE MI: dashboards of charts containing management information sourced from the regulatory data that has been collected and confirmed anyway for regulatory compliance.

⁄Software as a service first

VERMEG has been enjoying huge success selling to challenger and digital banks. These customers tend have the view that no IT infrastructure is the best IT infrastructure. They prefer VERMEG to operate and maintain the solution rather than take licensed software to operate and maintain themselves, ie software as a service (SaaS). VERMEG has pedigree here, launching a SaaS solution on Amazon Web Services (AWS) in UK in 2015. VERMEG has recently passed the latest milestone in its SaaS journey with SOC 2 type II accreditation and its first SaaS customer will go live in Q2 on a ‘full allocation’, end-to-end SaaS solution for USA reporting (Federal Reserve, FFIEC).

Download the Newsletter