Exhaustive life insurance solution.

Soliam

Manage the entire value chain with security and autonomy using Soliam, our integrated core solution for portfolio management.

Soliam enables asset owners and wealth managers to unlock efficiency and achieve greater control over the entire investment lifecycle.

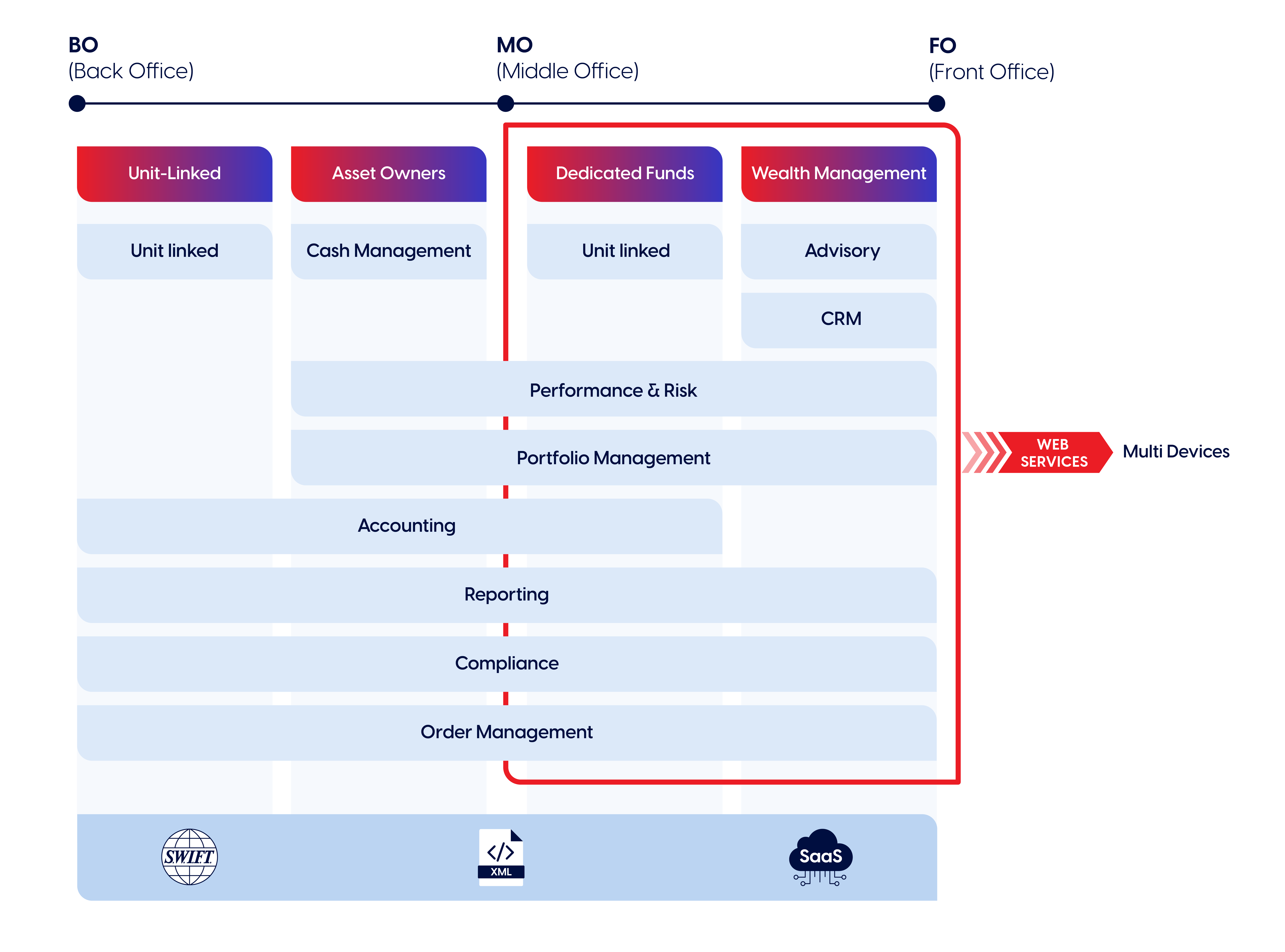

Fully integrated as a front-to-back solution, Soliam supports your multi-asset, multi-entity, and multi-currency operations with scalability.

Enhanced decision-making

Achieve real-time portfolio management, enabling smarter, faster decision-making for asset managers with SOLIAM’s comprehensive dashboards, analytics, and data-driven insights.

Streamlined operations

Increase operational efficiency across front, middle, and back offices — from order management to compliance and accounting — thanks to a fully integrated, modular platform design.

Future-proof solution

With you for the long haul: From cloud services to web APIs, advanced security and more, SOLIAM’s continuous updates ensure you never miss out on valuable innovations.

Enhanced decision-making

Achieve real-time portfolio management, enabling smarter, faster decision-making for asset managers with Soliam’s comprehensive dashboards, analytics, and data-driven insights.

Streamlined operations

Increase operational efficiency across front, middle, and back offices — from order management to compliance and accounting — thanks to a fully integrated, modular platform design.

Future-proof solution

With you for the long haul: From cloud services to web APIs, advanced security and more, Soliam’s continuous updates ensure you never miss out on valuable innovations.

Asset owners, wealth managers, dedicated funds, and unit-linked insurance address critical portfolio management challenges with Soliam.

From order management to performance tracking, Soliam’s unrivalled modular configuration empowers you to adapt seamlessly to varying business needs.

With integrated dashboards providing real-time insights into risk, performance, and operations, Soliam’s ensures rigorous compliance with global standards like MIFID II, Solvency II, and IFRS9.

Front-to-back solution

Manage your entire investment value chain and get visibility across all functions on a single solution — from portfolio management to accounting, compliance, and reporting.

Multi-asset class support

Manage diverse portfolios with greater efficiency. Asset owners and wealth managers handle all asset classes on SOLIAM, including equities, fixed income, real estate, and derivatives.

Compliance with standards

With SOLIAM’s pre- and post-trade compliance features, ensure regulatory adherence to frameworks like IFRS9, MIFID II, ESG, and Solvency II. Automated compliance checks increase intellectual bandwidth and peace of mind.

SaaS and cloud integration

Work with a solution that adapts to your needs. Available in SaaS, ITO, or on-premises configurations, SOLIAM comes with built-in security, performance scalability, and reduced operational risk.

Dashboard plug-and-play screens

Empower people to deliver their best with customizable, ergonomic dashboards for all sectors. Unlock new levels of collaboration and efficiency by sharing dashboards with all users or specific groups only.

Download the comprehensive brochure to learn more about Soliam’s full capabilities and features for front-to-end investment management.

Explore expert insights, industry perspectives and thought leadership. Discover how Vermeg’s technology supports institutions across Capital Markets and Insurance in navigating today’s evolving landscape.

Exhaustive life insurance solution.

Flow integration application for all formats of data, protocols and files.

Understand how Soliam can streamline your investment management processes, from front-to-back operations to advanced reporting.

With over 30 years of expertise, we are dedicated to delivering exceptional client service whilst transforming financial operations through our innovative offerings in capital markets and insurance.

Subscribe to our newsletter

Capital Markets

Insurance

Solutions

About Us

Resources

Careers

Copyright ©2026 Vermeg GROUP B.V – All rights reserved.