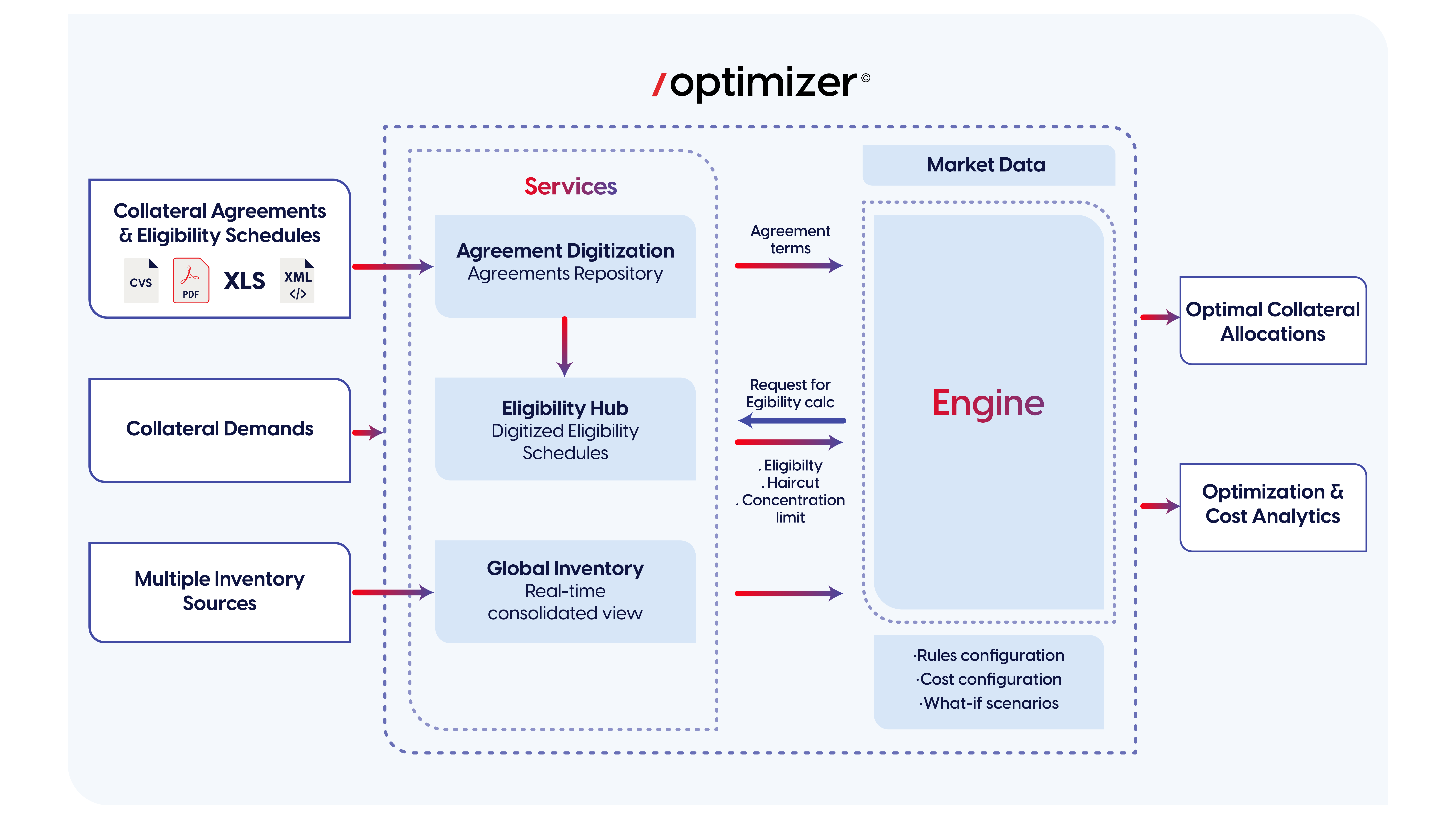

Optimizer platform is a standalone intelligent Hub to optimize collateral assets, unlock liquidity and reduce funding costs: it digitizes agreements, consolidates inventories, applies advanced strategies, and automates allocations, delivering speed, simplicity, and resilience when markets are under stress.

Collateral scarcity, liquidity pressures, and tightening regulations (LCR, NSFR, leverage ratios) are challenging financial institutions like never before.

At the same time, volatility is forcing faster, smarter, and simpler collateral decisions. Traditional, manual processes can’t keep up.

Optimizer is the perfect solution to lower operational and funding costs, automate your collateral deliveries, transform your collateral assets and maximize the usage of your inventories for optimal decisions.

Digitize Agreements

Automatically extract, normalize, and integrate collateral terms from CSA, GMRA, GMSLA, ISLA, TBA, and Clearing Agreements

Upload Inventory

Import exposures and collateral asset pools across desks and entities into a single dashboard

Set your Optimization Strategy

Define your business goals, ranking rules and optimization scope

Optimize Collateral Demands

Automated, efficient allocations across counterparties

Agreements and Eligibility

Schedules Digitization

Converts dense legal contracts into dynamic, structured data

Embedded Complex Eligibility Calculation

Instant verification of any asset against the agreement eligibility rules, guaranteeing real-time compliant allocation

Automated Collateral Allocation

and Continuous Re-Assessment

Instantly delivers optimal allocation and continuously monitors pledged collateral in real time, adapting to market changes to reduce manual effort and operational risk.

Advanced Optimization Algorithms

Harness simplex and mixed-integer programming to balance cost, liquidity, concentration limits, and eligibility rules.

Cost Configuration and

Available Market Data

Define and customize opportunity cost while leveraging market data such as FX rates, referential data, and prices.

Cross-Asset Class Coverage

Supports derivatives, repos, securities lending, CCP margin calls, and central bank operations.

Scenario Simulation and Stress Testing

Run “what-if” scenarios to anticipate collateral mobilization needs under market volatility or regulatory shocks.

Optimization Reporting

Generates instant snapshots with key performance indicators (cost savings, liquidity usage, operational efficiency).

Automated Collateral Allocation

Generates the most allocation instantly, minimizing manual intervention and operational risk.

Advanced Optimization Algorithms

Harness simplex and mixed-integer programming to balance cost, liquidity, concentration limits, and eligibility rules.

Scenario Simulation & Stress Testing

Run “what-if” scenarios to anticipate collateral mobilization needs under market volatility or regulatory shocks.

Continuous Re-Assessment

Monitors pledged collateral in real time and reassesses its optimality as markets shift.

Cross-Asset Class Coverage

Supports derivatives, repos, securities lending, CCP margin calls, and central bank operations.

Optimization Reporting

Generates instant snapshots with key performance indicators (cost savings, liquidity usage, operational efficiency).

Download brochure to better understand how Optimizer can help your collateral asset management.

Robust solution to optimize and automate asset allocations.

Flow integration application for all formats of data, protocols and files.

Digital platform for seamless, automated end-to-end individual life subscriptions, from KYC to contract insurance.

Solution to unlock unparalleled efficiency.

A strategic solution for ISO 20022 compliance.

A strategic solution for ISO 20022 compliance.

Solution to unlock unparalleled efficiency.

Digital platform for seamless, automated end-to-end individual life subscriptions, from KYC to contract insurance.

Flow integration application for all formats of data, protocols and files.

Robust solution to optimize and automate asset allocations.

Flow integration application for all formats of data, protocols and files.

Solution to unlock unparalleled efficiency.

Next-gen digital onboarding for group insurance.

Seamless control over financial planning for active employees and pensioners.

Automated end-to-end subscription process for collective health and life solutions.

Solution for streamlining individual life insurance subscription and endorsement processes.

Policy insurance life-cycle management solution for most “non-life” business lines.

Automated end-to-end subscription process for individual health solutions.

Anticipate compliance challenges with Client Data Collector: the key solution for managing and updating customer data.

Anticipate compliance challenges with Client Data Collector: the key solution for managing and updating customer data.

Automated end-to-end subscription process for individual health solutions.

Policy insurance life-cycle management solution for most “non-life” business lines.

Solution for streamlining individual life insurance subscription and endorsement processes.

Automated end-to-end subscription process for collective health and life solutions.

Seamless control over financial planning for active employees and pensioners.

Veggo’s user-friendly platform makes implementing digital transformation effortless. Keep your company competitive in the rapidly evolving global market by creating custom, scalable applications quickly and efficiently.

30+ years of business expertise

Over 60 ready-to-use digital components

Top-tier technical performance

Veggo’s user-friendly platform makes implementing digital transformation effortless. Keep your company competitive in the rapidly evolving global market by creating custom, scalable applications quickly and efficiently.

Consult a Vermeg specialist to see how Veggo solutions can streamline your operations and boost your productivity.

With over 30 years of expertise, we are dedicated to delivering exceptional client service whilst transforming financial operations through our innovative offerings in capital markets and insurance.

Subscribe to our newsletter

Capital Markets

Insurance

Solutions

About Us

Resources

Careers

Copyright ©2026 Vermeg GROUP B.V – All rights reserved.