Robust solution to optimize and automate asset allocations.

Colline

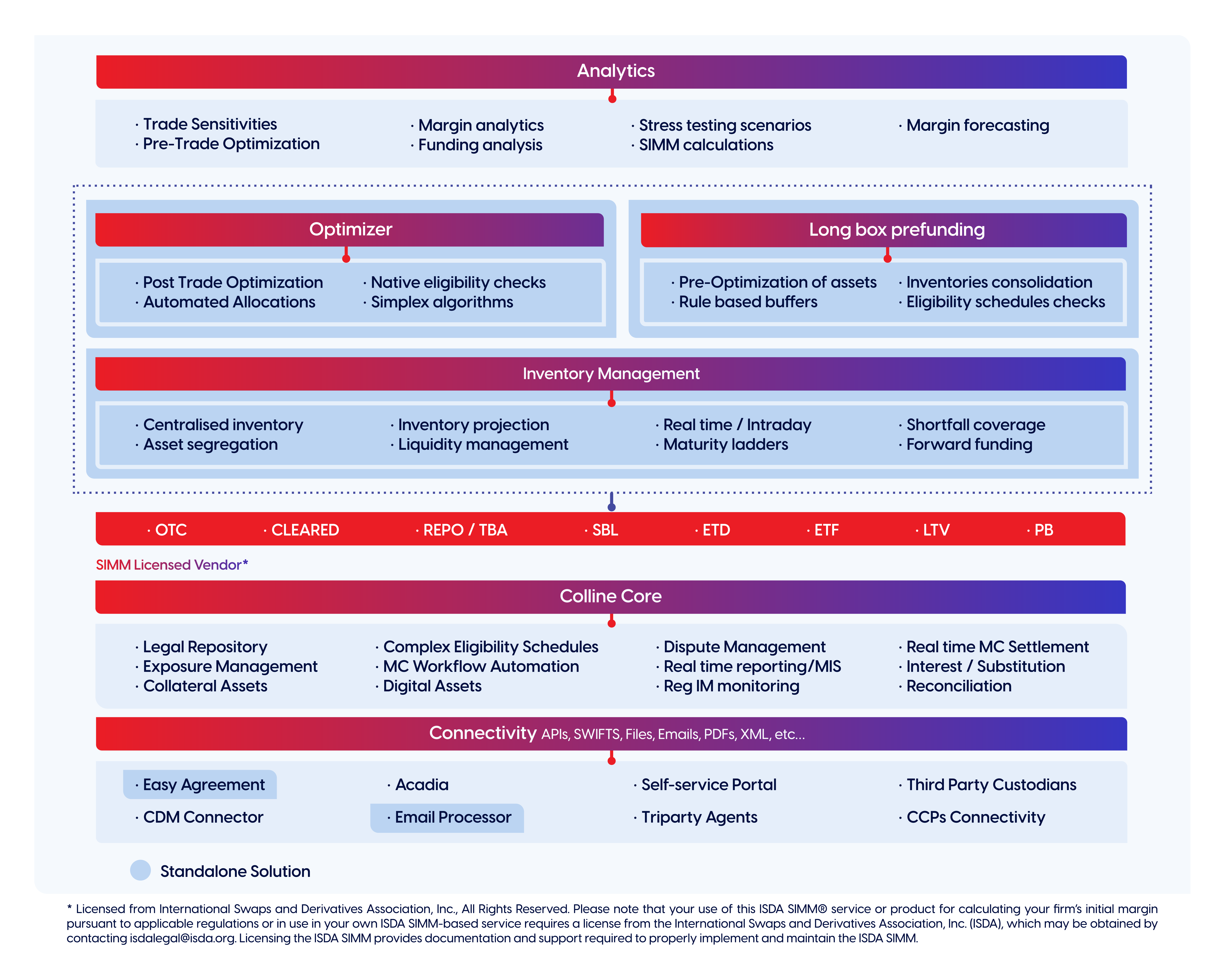

Control risk, manage collateral services, and leverage margin automation across all asset classes with our cutting-edge Colline solution.

Designed specifically for banks, asset managers, and servicers, our Colline web-based platform enables you to optimize costs, automate margin calls, and improve liquidity.

With Colline, manage collateral workflows across asset classes — from derivatives to repos, SBL, TBAs, and ETDs. Additionally, enhance your operational efficiency while reducing IT costs by capitalizing on scalable SaaS technology and PostgreSQL.

Reduce total collateral management costs

Consolidate and automate workflows across asset classes, leveraging SaaS to reduce IT and funding costs.

Regulatory compliance

Ensure seamless adherence to evolving regulations, reducing risk for financial institutions.

Boost operational efficiency

Enhance value-added collateral services to improve operational efficiency and asset utilization.

Forward ladder inventory views

Improve visibility with forward ladder inventory, enabling proactive asset management.

Optimization algorithms

Run bespoke and defined algorithms to maximize collateral efficiency and optimize asset allocation.

Reduce total collateral management costs

Consolidate and automate workflows across asset classes, leveraging SaaS to reduce IT and funding costs.

Regulatory compliance

Ensure seamless adherence to evolving regulations, reducing risk for financial institutions.

Boost operational efficiency

Enhance value-added collateral services to improve operational efficiency and asset utilization.

Forward ladder inventory views

Improve visibility with forward ladder inventory, enabling proactive asset management.

Optimization algorithms

Run bespoke and defined algorithms to maximize collateral efficiency and optimize asset allocation.

Centralized risk management, margin automation and collateral services across all asset classes.

· Over-the-counter (OTC) derivatives, Cleared OTCs derivatives, Repo, Securities-based lending (SBL), To-be-announced trades (TBAs), Exchange-traded derivatives (ETDs)

· Onboarding of new standards such as the common domain model in credit support annex (CSAs), Complex eligible collateral schedule representation

Governing agreements across all asset classes

Margin-based activities daily ensuring efficient STP

End-to-end collateral management

Cross-asset coverage

Regulatory compliance

Real-time processing

Collateral optimization

Integration capabilities

Risk management

Reporting and analytics

Download the comprehensive brochure of Vermeg’s collateral management solution.

Explore expert insights, industry perspectives and thought leadership. Discover how Vermeg’s technology supports institutions across Capital Markets and Insurance in navigating today’s evolving landscape.

Robust solution to optimize and automate asset allocations.

Leading suite for post-trade processing.

Connect with our dedicated sales team for personalized offers that align with your unique needs and aspirations.

With over 30 years of expertise, we are dedicated to delivering exceptional client service whilst transforming financial operations through our innovative offerings in capital markets and insurance.

Subscribe to our newsletter

Capital Markets

Insurance

Solutions

About Us

Resources

Careers

Copyright ©2026 Vermeg GROUP B.V – All rights reserved.