SOLIAM Newsletter Issue 5 | Q1 | 2021

SOLIAM 14.3.0

Welcome to the first newsletter of 2021 for VERMEG’s Wealth & Asset Management solution. We aim to keep you informed on what VERMEG’s achievements and vision for the future. SOLIAM version 14.3.0 will be released in the first week of April and will focus on improving unit-linked cycle features. It contains the management of currency exchange and arbitration for liability flows. This release also introduces our new digital journey offering – a mobile device application.

Management of arbitration for liability flows

We are continuously improving and enriching the solution’s Unit-Linked functionalities. Starting from the 14.3.0 version, SOLIAM will be able to accept liability flows expressed in percentage, in quantity or in amount. This functionality facilitates Arbitration and ensures:

- The calculation of the amount of investment for multiple instruments.

- The exclusion of certain flows linked to fees, meaning that they’re not included in the investment amount.

- The conversion of the flow to the instrument currency & generation of the market order.

A new configuration component has been added allowing the control of arbitration activation and the conversion of percentage into amount. The aggregation function already available in SOLIAM now uses this before generating market orders linked to investment flow.

It is important to mention that the full history of the flows underlying the workflow of liability management is available for checking and investigation.

Management of currency exchange for liability flows

As part of our enhancement of the Unit-Linked process, the automatic generation of FX Spot requests when the flow currency is different from the currency of the investment flow has been implemented. This new functionality allows :

- Automatic generation of the FX Spot order (currency conversion) to convert the amount in the flow to the currency of the asset.

- Generation of the grouped FX Spot order in SOLIAM’s order book. The grouping is by portfolio and by currency.

- Creation of the link between the liability flow and the FX Spot order.

Again, full audit information resulting from this activity is recorded and available for checking and investigation.

Mobile App for Private Wealth Management

Two new mobile apps are now available for Private Wealth Management. One mobile app being designed for the Relationship Manager and the other for the end client.

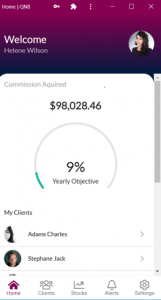

Mobile app for the Relationship Manager

1/ The homepage of the RM is a dashboard displaying :

- Commission earned and collected by the client’s manager starting from the beginning of year and the progress of manager’s annual objectives.

- A list of the managed clients with their photos.

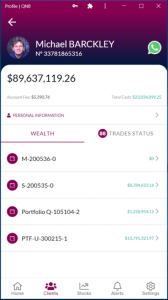

2/ Client Portfolio: The RM can select a client and view their list of portfolios and associated value. Client’s trades are also available on the screen.

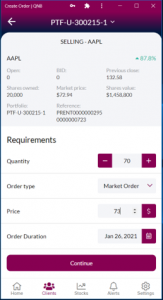

3/ Finally the manger can create a market order for

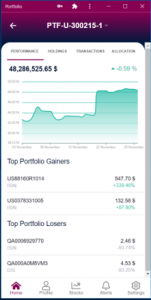

Mobile app for the end client

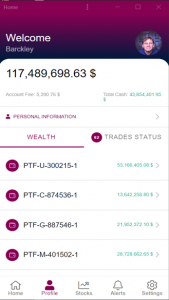

4/ The client can directly access their wealth valuation & trades.

5/ Clients can also view the performance of each portfolio with the top performer positions.

6/ Clients can see portfolio allocation as well as suitability against the model portfolio.

Upcoming

The upcoming release in June 2021 will bring enhancement of company box.

SOLIAM’s Sandbox is currently being validated and more information will be available in the next Newsletter.

Download the Newsletter

If you’d like to have more information on SOLIAM, please write to communication@vermeg.com