CUSTODIX Hub

Automated

Custodian Data Handling

Custodian Data Handling

This innovative solution meets the key challenges of life insurance companies: Collecting and processing financial data.

Custodix Hub facilitates the flows and financial data exchanges between custodian banks and insurance companies, in a trusted and secure environment.

Tackling the financial data collecting and processing challenges

Central Hub for Insurers

In today’s digital environment, life insurers and other external asset management firms face significant challenges in collecting and processing data from custodial banks.

Custodix Hub aims to strengthen and facilitate the relationship between the two stakeholders.

It provides standardized and automated data extraction and processing, which greatly improves time, efficiency and cost.

Clients benefit from the key expertise of two leading companies:

- VERMEG’s industry knowledge in the fields of Banking, Wealth & Asset Management, and Insurance

- LUXHUB’s trusted environment, operational excellence and Open Banking pioneer status

Meeting the strategic challenges

Profit from critical industry knowledge

The combination of functional and technical know-how enables the easy integration of complex data (position reports, securities and monetary transactions, look-through data, new asset class derivatives, Solvency 2, etc.). No development required.

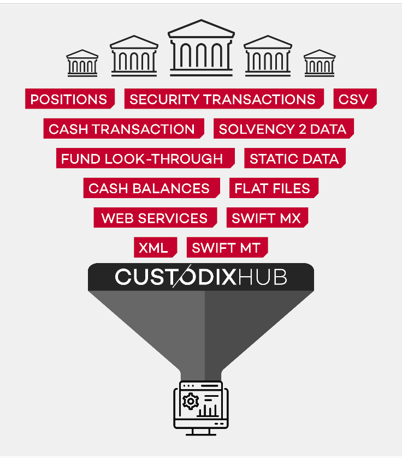

Custodix Hub enables collection and processing of custody account data, automatic updating and adaptation of standard formats, and easy integration into information systems.

Easy to customize and deploy new Custodians

In a dynamic environment, formats evolve and require regular interface reviews. Additionally, new custodians and interfaces often need to be added.

Use extensible solutions that adapt smoothly and quickly to new needs and requirements.

Focus on your core business and outsource the rest

Significant cost and time savings can be reached by efficiently outsourcing connectivity, conversion and maintenance.

Our solutions enable insurers to automate the processing of various data types through one common platform, including Swift MT or MX files, proprietary formats, XML files, FIX and web services.

“With this innovative solution, we are mutualizing the effort, for all insurers, and we will have more impact toward the custodian banks to request more automation. At the end of the day, insurers will be able to continue to focus on their core business,” Eric Bemelmans Director, Digital Transformation, at VERMEG.

Efficient Automation

Costs Reduction

Faster time-to-market

Easy customer onboarding

Monitoring services

Leverage the Hub Effect

Through the automatic data injection into the PMS, insurers will be able to use increased quality data while reducing their operational risks through an elimination of manual tasks. They will also gain in efficiency through automation, with a significant reduction of costs,

To offer the service and the solution with the right level of security and scalability, partnering with leading Fintech LUXHUB was the right and obvious choice. Together we bring more value to the insurance sector, as well as operational efficiency, service efficiency and innovation in an “Open” and interconnected world,