Newsletter MEGARA Issue 9 | Q1 | 2022

Date

VERMEG is the winner of the COLLATERAL MANAGEMENT SERVICES AWARD by CENTRAL BANKING 2022

We are proud to announce that VERMEG has been named the winner of Central Banking’s Collateral Management Services Award 2022.

This award is a recognition to the entire team’s hard work and confirms VERMEG’s position as the leading provider of infrastructure solutions in the collateral management and post-trade processing area.

MEGARA is built as a modular suite of tools tailored to specific client infrastructure objectives.

MEGARA is ISO20022-compliant which is a material assurance to current and prospective clients. Particularly pertinent in the present operating environment is that Megara incorporates built-in security features to guard against data corruption, leaks and hacking.

The Central Banking publication commented on VERMEG: “The firm has added another G7 central bank to its list of clients, and is immersed in a major project to build the eurozone’s new collateral management system.” Read the full Press Release by Central Banking about the Award win.

VERMEG certified SOC2 Type II

Reaching this milestone is a result of the hard work and involvement of all departments in VERMEG.

SOC 2 audit and certification ensures VERMEG is storing, handling and transmitting while ensuring privacy, security, availability, integrity and confidentiality.

Blockchain Strategy – Digital Asset Platform

Last year, we connected MEGARA to several blockchains platforms which are popular in the financial industry.

We have successfully settled token and liquidity transfers in both Ethereum and Binance chains, and DVP transactions in Liquidshare.

This year, we are enhancing MEGARA’s position as a multi-asset platform offering full custody services for both traditional and crypto assets by integrating MEGARA into the crypto ecosystem.

This will be done by focusing on:

⁄ Extending MEGARA’s capabilities through integration with new platforms such as Corda, and by increasing the functional coverage to new transaction types (Mint, Burn, etc.);

⁄ Integration with other actors in the Crypto ecosystem such as Crypto exchange facilities and third-party wallet providers.

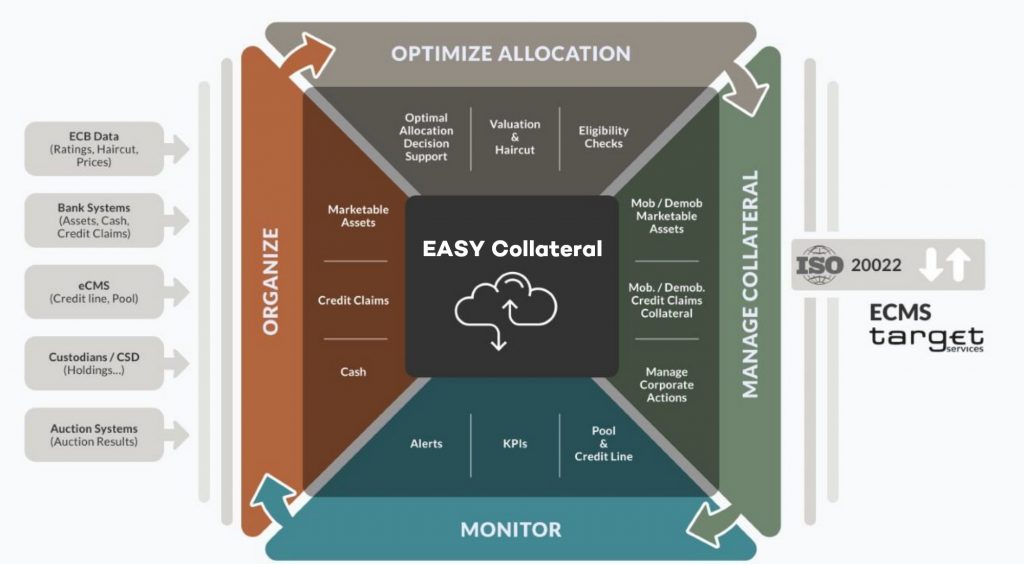

Easy Collateral by VERMEG

With the Eurosystem harmonized collateral management platform going live next year, the banks have to prepare their information systems to comply with the ECMS calendar imposed by the European Central Bank. Daily treasury management needs to cope with all the new processing and messaging rules dictated by the Eurosystem, and all adaptation needs to be completed by mid-2022.

VERMEG launched a software solution to connect Banks to the Eurosystem Collateral Management System (ECMS). Easy Collateral is a SaaS turnkey solution, specifically designed for bank treasurers to seamlessly integrate with ECMS. It relies on the same parameters used by ECMS for collateral assessment in terms of eligibility, valuation, and messaging. Customers can easily connect to their EASY Collateral account from desktop or mobile devices, to get immediate access to their dashboard and collateral steering tools.

Easy Collateral allows banks and treasury teams to:

⁄ visualize, organize, and manage your inventory of Marketable Assets and Credit Claims;

⁄ get a real-time view of your pool of collateral and your exposure as it sits in ECMS;

⁄ increase your Collateral Allocation efficiency with the automated Optimal Allocation Assistant;

⁄ mobilize and demobilize assets in a flash and let the tool generate the relevant ready-to-send ISO 20022 messages to ECMS;

⁄ get informed about all the alerts affecting your inventory and pool of mobilized collateral;

⁄ enjoy a new, digitalized collateral management experience with an innovative UX.

News & Perspectives for 2022

Several infrastructure changes are now ongoing in the Euro-Zone. The major one is the ECMS platform that will be going live in 2023 and the T2 T2S consolidation.

This means that several evolutions in term of processing and interfacing with the European Central Bank are expected, and they will have an impact on CSDs in Euro-zone custodians.

For 2022, the focus is mainly on the following areas to help the different market actors to accommodate these changes:

⁄ Enrich the CSD offering: This involves more streamlined processing in accordance with ECMS guidelines.

⁄ Help collateral providers better manage their collateral with ECMS.

Download the Newsletter