/ Welcome to Our Latest Newsletter!

In today’s rapidly evolving financial landscape, effective collateral management is more crucial than ever. As we navigate the complexities of financial markets, innovative solutions are transforming how we manage and optimize collateral.

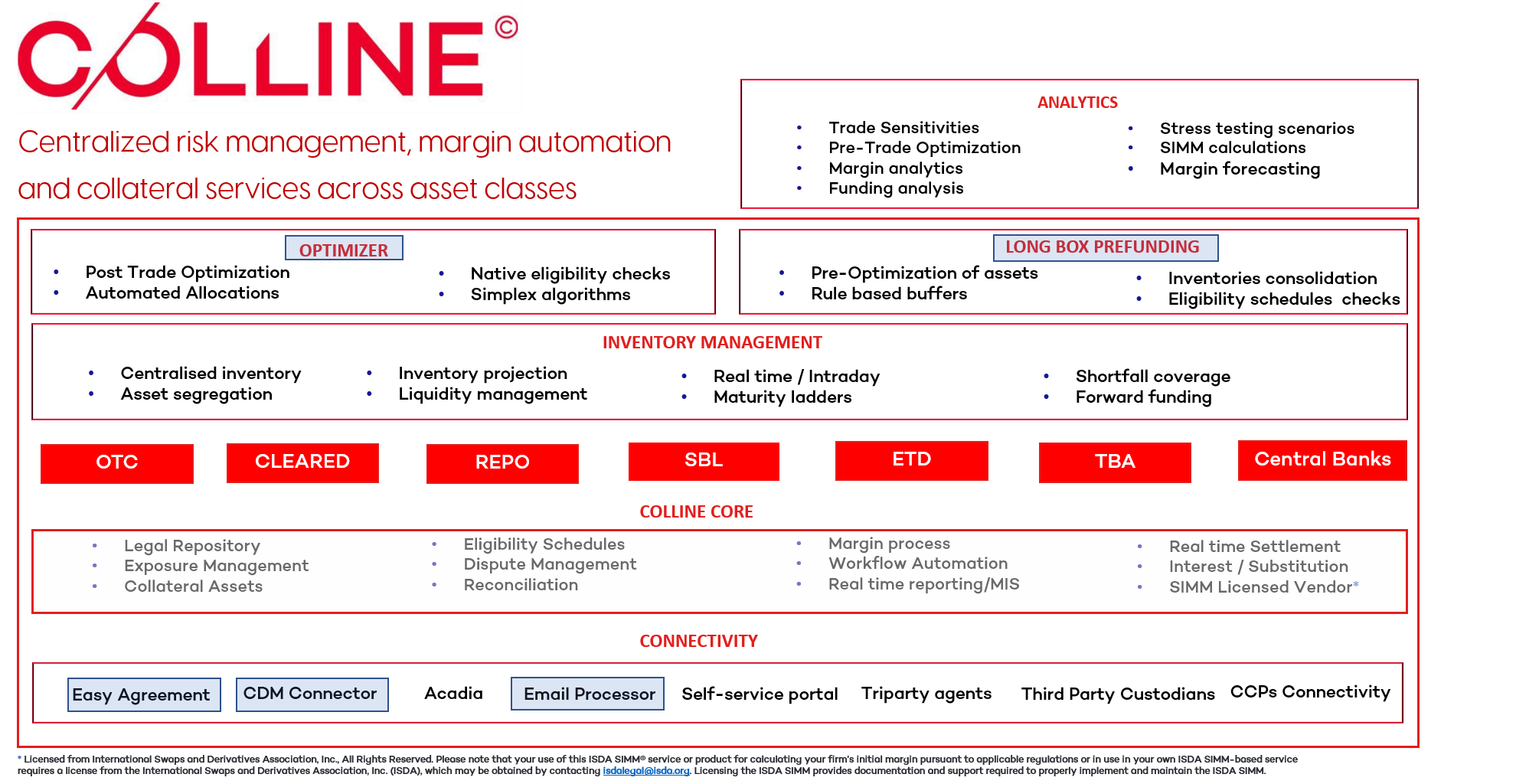

At VERMEG, we envision a future where advanced solutions revolutionize collateral management through extensive automation, streamlined connectivity, in-depth functional features, and cutting-edge technologies.

Automation ensures seamless and efficient processes, minimizing human error and saving valuable time. Connectivity goes beyond integration to margin utilities and digital settlement venues, embracing market data standards like the Common Domain Model. Our focus on functional features tailors’ solutions to meet your current and future business needs, driving performance and profitability.

Meanwhile, our commitment to pioneering technologies keeps us at the industry’s forefront, continuously adapting to the latest advancements.

Download our Newsletter to explore the exciting advancements in collateral management. Together, we can prepare for the imminent and transformative shift brought about by Artificial Intelligence.

/ Colline 2024 Collateral Initiatives

/ Common Domain Model (CDM) Connector: The CDM provides a standardized, machine-readable blueprint for financial products, facilitating seamless integration and management of CSAs, GMRAs, GMSLAs, and Eligibility Schedules.

/ Long Boxes Funding Optimization: This involves securing optimal buffers to meet margin requirements across various asset classes. Techniques include centralized collateral long boxes, algorithmic rules, and automated settlement processes.

/ Digitization of Legacy PDFs: AI models can digitize legacy documents like CSAs, GMRAs, GMSLAs, and Eligibility Schedules, improving accessibility and management.

/ Automation of inbound emails through IA for margin workflow and interests’ reconciliation.

/ Rehypothecable Assets in Collateral Optimization: Including rehypothecable assets in optimization runs can enhance collateral efficiency and liquidity management.

/ Real-Time & Event-Based Data Streaming: Implementing real-time and event-based data streaming improves decision-making and operational efficiency by providing timely data to clients and internal systems.

/ AI Integration: Using AI chatbots, assistants, and agents can further automate processes, reducing operational frictions and enhancing efficiency.

/ Transition to Swift ISO 20022: This new standard for financial messaging enhances data richness and operational efficiency. The transition from ISO 15022 to ISO 20022 for cash and securities instructions is ongoing, with a switch expected by November 2025.

/ Colline Future Vision

Ensuring regulatory compliance, particularly with US Treasuries and Repo clearing in 2025-26, remains a top priority for COLLINE. However, the platform’s evolution will also focus on achieving greater efficiencies through technological innovations and enhancing connectivity with analytics functions and digital utilities. This dual approach aims to streamline operations, reduce costs, and leverage advanced technologies to stay ahead in the evolving collateral management landscape.

/ Colline is announced as “Best Sell-Side Collateral Management Solution” by the FTF News Technology Innovation Awards 2024

VERMEG’s COLLINE has been awarded “BEST SELL-SIDE COLLATERAL MANAGEMENT SOLUTION 2024“ for its outstanding performance and innovation in the financial technology sector.

COLLINE’s robust customer base includes a diverse range of clients, across Sell side, Buy side and Asset Servicing firms, reinforcing its position as the most flexible solution in the market. It is today one of the established solutions on the market that manages over 250,000 governing agreements across all asset classes. Our rules-based products facilitate over 15,000 margin-based activities daily, ensuring efficient STP. It’s utilized by 16 tier 1/2 clients and 57 market participants to manage their business across derivatives, clearing, repos, commodities TBAs and securities activity.

COLLINE continues to provide an intuitive user experience and supports a fair pricing model for each client.

/ Vermeg Integrates Common Domain Model into Colline Collateral Management System

VERMEG has successfully integrated the Common Domain Model (CDM) into its COLLINE collateral management platform, a significant move aimed at digitizing regulatory Initial Margin (IM) credit support annexes (CSAs). The CDM, a free-to-use data standard for financial products and lifecycle events, reduces operational risks, minimizes errors, and accelerates onboarding for clients.

Through this integration, data from regulatory IM CSAs negotiated on ISDA’s Create platform can seamlessly flow into COLLINE, streamlining contract lifecycle management and eliminating costly manual processes.

As the first technology provider to adopt CDM for collateral processes, VERMEG sets the stage for greater efficiency in collateral representation, margin settlement, and risk mitigation, with other firms expected to follow.

/ Colline Events 2024

ISDA 38th AGM

16 -18 April 2024 / Tokyo

VERMEG team was delighted to attend ISDA AGM in Tokyo, last April 2024. Inspiring sessions, keynotes and panels on Industry initiatives, key trends of the Japanese market and the overall ecosystem unveiled and unmissable networking opportunities.

An amazing CDM-Collateral pre-conference Roundtable was an unmissable discussion delivering resources to build a business case and sharing about efficiency to onboard new counterparties, lifecycle management and collateral inventories optimization.

Global Collateral Management Summit

18 -19 April 2024 / Lisbon

VERMEG participated in the 7th Global Collateral Management Summit in Lisbon, Portugal where we took the stage as keynote and panel speakers: stimulating panel discussions to enriching exchanges around Collateral Management and Optimization with industry leaders.

ISDA London

12 June 2024 / London

We were pleased that Wassel Dammak, Head of Collateral Solutions Strategy at VERMEG, was among the distinguished speakers at the ISDA/IA Collateral Management Evolution Conference on June 12, 2024, in London.

Our Head of Collateral Solutions Strategy joined the ‘Technology Solutions Leading to Interoperability’ Panel, discussing how the Common Domain Model is driving standardization and interoperability, and how infrastructures and fintech firms are working with their clients to automate processes and implement AI solutions to streamline operations and reduce risks

Fleming 18th Annual Conference

09 -10 October 2024 / Amsterdam

VERMEG was a Gold Sponsor at Fleming’s 18th Annual Collateral Management Forum, who took place on October 9-10, 2024, in Amsterdam.

Our Head of Collateral Solutions Strategy, Wassel Dammak offered valuable insights for businesses aiming to optimize their Collateral Optimization processes, from selecting the right resources and setting up governance structures to ensuring accurate data collection and harnessing advanced technologies.

SIBOS 2024

21 -24 October 2024 / Beijing

VERMEG was at the SIBOS event on October 21-22 and to showcase it is driving innovation in collateral management and digital transformation. Our delegates were on-site to discuss our solutions in-depth, share insights on industry trends, and show how we can help business stay ahead in the ever-evolving financial landscape.

SYMPOSIUM 2024

12 November 2024 / London

VERMEG was delighted to participate in the Symposium Event in London in November 2024. Our Head of Collateral Solutions Strategy, Wassel Dammak, was a featured panelist at the panel “The Collateral Era“, sharing his insights on the latest trends and challenges in collateral management.

EUROCLEAR Collateral Conference 2024

14-15 November 2024 / Brussels

VERMEG was present at the Euroclear Conference in Brussels on November 14-15. The conference becomes the epicenter of the collateral management market, with senior professionals and thought leaders gathering to share their collective insights and connect the entire market to inspire changes for the future direction and growth of the market.