Dear Clients, Partners, and Industry Peers,

The first half of 2025 has been a defining chapter in the evolution of financial market infrastructure. With the long-anticipated go-live of ECMS, the acceleration toward T+1 settlement in Europe, and the integration of digital assets into collateral operations, we are witnessing a true inflection point—where resilience, real-time processing, and intelligent automation are no longer optional, but essential.

At Vermeg, we are proud to have stood at the center of these changes, not just as a solution provider, but as a strategic partner. From powering ECMS for the Eurosystem to supporting national reforms in Spain and enhancing automation for global central banks, our platforms continue to deliver on scale, security, and speed.

We’ve also seen our Colline solution extend its leadership across both buy- and sell-side institutions—earning industry-wide recognition while helping clients navigate complex optimization and regulatory challenges. And we continue to invest in product innovation, ESG alignment, and AI integration to future-proof your operations.

This newsletter is more than a recap. It’s a window into how our teams, clients, and solutions are shaping the future of post-trade and collateral management together. You’ll find strategic updates, market insights, and real-world success stories that demonstrate what’s possible when technology and partnership meet at the right moment.

Warm regards,

Khaled Ben Abdeljelil

Senior VP, Banking Market Strategy

Spotlight - ECMS is Live!

/ A Unified Collateral System Reshapes Europe’s Post-Trade Infrastructure

On June 16, the European Collateral Management System (ECMS) launched as a unified platform to streamline collateral and liquidity operations across the Eurosystem. Built on Vermeg’s Megara suite, ECMS replaces over 20 national systems and connects 2,500+ financial institutions. It integrates with key Eurosystem platforms and follows ISO 20022 standards, delivering greater collateral mobility, reduced risk, and a future-proof infrastructure. This milestone highlights Vermeg’s trusted role in European market infrastructure.

Collateral Management & Optimization

Market volatility, liquidity stress, and evolving regulatory requirements have accelerated the demand for real-time, intelligent, and sustainable collateral strategies. Vermeg’s Colline solution continues to lead the way across both the buy- and sell-side segments.

Market Trends & Insights

/ A Holistic Approach To Collateral Optimization

Effective collateral optimization is vital amid regulatory and market challenges. A holistic approach with strong governance and quality data helps improve efficiency and manage liquidity.

/ The Next Era of Collateral: Seamless, Smart, and Sustainable

Collateral management is rapidly evolving due to regulations, market changes, and sustainability demands. Vermeg’s Wassel Dammak highlighted key industry shifts and how firms must adapt to stay resilient and competitive.

Product highlights

/ The Future of Collateral Management: From Automation to Intelligence

For over 20 years, Vermeg’s Colline has driven innovation in collateral management. Now powered by AI, it’s evolving into a network of Collateral Intelligence Agents that optimize assets, automate processes, and deliver real-time insights. Operating 24/7, Colline boosts efficiency, cuts costs, and reduces risk—setting a new benchmark for intelligent, data-driven collateral management.

Market recognitions

/ Vermeg is SOC 2 Type II compliant

Vermeg achieved SOC 2 Type II compliance for the fourth year running with zero deviations, confirming its strong commitment to security and compliance. The report is available under NDA via the Sales team.

/ Colline is winner at the FTF News technology Awards Sell and Buy sides

Vermeg’s Colline won the 2025 FTF Awards for Best Buy-Side and Sell-Side Collateral Management Solution, recognizing its integrated support for both markets and reinforcing its trusted industry position.

Post-Trade Transformation

As the drive toward T+1 settlement and harmonized standards continues to reshape post-trade operations, Vermeg remains at the forefront with solutions that balance agility, compliance, and scalability.

Market Trends & Insights

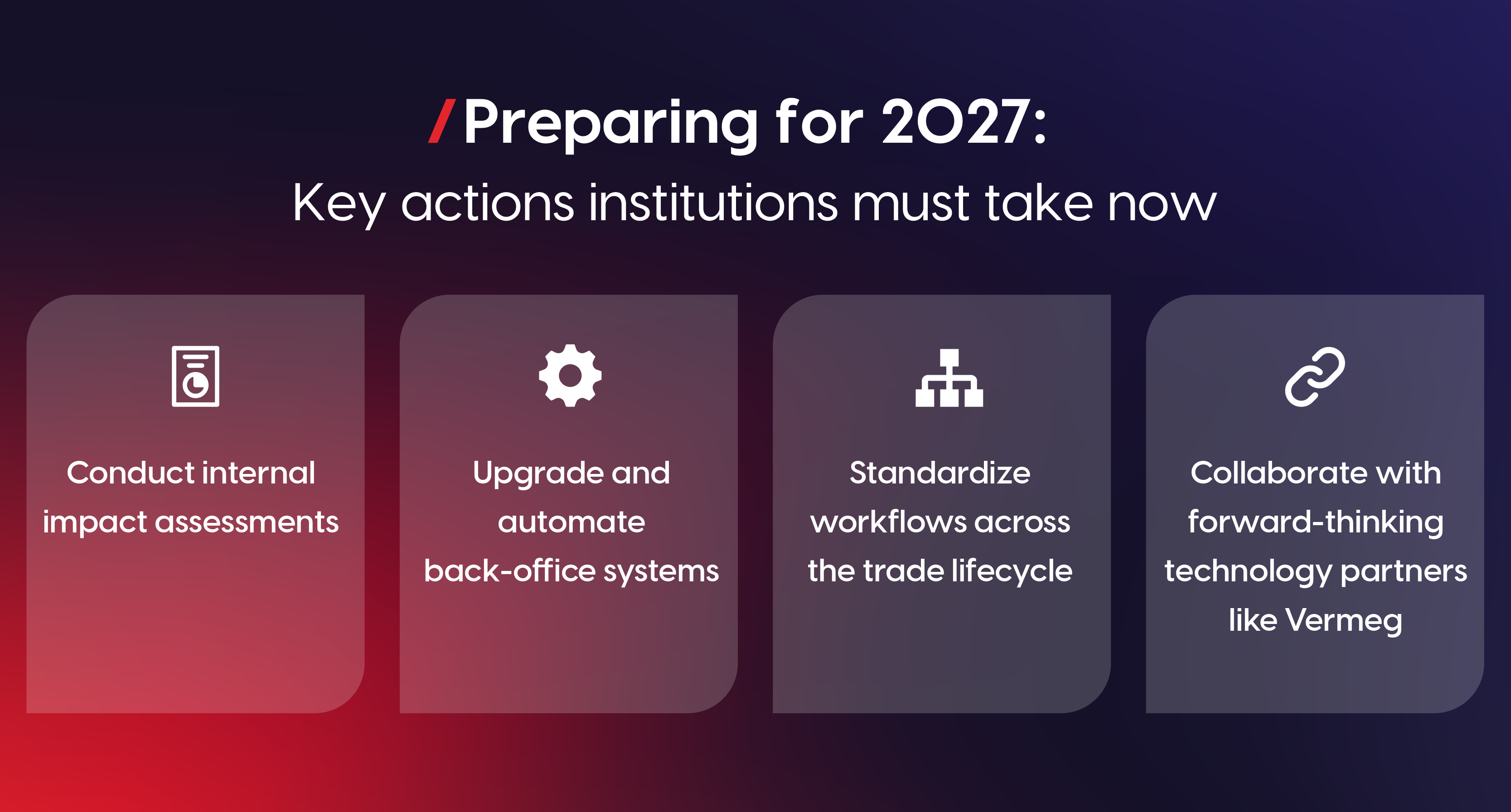

/ Europe’s Move to T+1 Settlement: A Game-Changer for Capital Markets

By October 11, 2027, Europe will shift to a T+1 settlement cycle, enabling faster, more efficient post-trade operations. Megara platform will be key in helping firms comply and succeed in the evolving digital capital markets.

/ Vermeg enables Reforma 3 Compliance in Spain via Megara Suite

On March 10, 2025, Spain launched Reforma 3 to align with T2S standards, boosting efficiency and transparency in post-trade processes. Megara Suite supported Spanish institutions by ensuring compliance and improving operational performance.

Market recognitions

/ Vermeg receives its trophy at the Central Banking Summer Meetings Ceremony 2025

Vermeg’s Megara won the 2025 Technology Services Award at the Central Banking Awards for modernizing post-trade and collateral operations. Praised for streamlining processes and enhancing liquidity, its impact was showcased by the Bank of Canada’s new securities-lending platform.

Client Success

/ Empowering Market Operations: A Major G7 Bank’s Blueprint for Resilience and Innovation

A major G7 central bank partnered with Vermeg to modernize its post-trade operations using Megara. The new system automates collateral processes, improves resilience, and increases efficiency—cutting processing times by 50%, automating fail handling, and enhancing liquidity support during market stress.

/ Optimizing Efficiency and Agility - Powering a major Central Bank payment operations through Xchanger Solution

A major European central bank partnered with Vermeg to enhance market operations using its Xchanger solution, improving reliability and efficiency. The solution reduced disruptions, maintenance, and labor costs by resolving 90% of incidents within SLA, ensuring stable and cost-effective services.

Highlights from Industry Events

Vermeg actively engages with the banking industry through conferences, expert panels, and market discussions to stay aligned with financial institutions’ needs.

This commitment drives the development of targeted, forward-looking solutions addressing key industry challenges.

Here are key highlights from the first half of the year.

The summit explored advanced strategies for collateral optimisation, with a focus on automation, AI, liquidity resilience, and multiasset class management in volatile markets.

The event focused on advancing MENA capital markets, with key themes including repos, securities lending, collateral management, blockchain, digital assets, and custody.

The agenda focused on the evolution of securities finance in the Middle East, highlighting the market development in the region, the growth of hedge funds, the integration of regional repositories, and their regulatory advancements.

The Network Forum 2025 focused on post-trade, custody, and network management trends. Key themes included T+1 settlement, digital assets, AI in finance, geopolitics, and operational resilience, with panels, roundtables.

Meet us at SIBOS 2025 in Frankfurt

Vermeg is excited to exhibit at SIBOS 2025 in Frankfurt, Sept 29–Oct 2! Join us at booth E43 to meet our experts and see how we help financial institutions streamline operations, reduce risk, and stay ahead. We look forward to connecting with you!

Discover our Solutions

Robust solution to optimize and automate asset allocations.

Leading suite for post-trade processing.

The collateral technology of the future.

Solution to unlock unparalleled efficiency.