The collateral technology of the future.

Megara

Central banks worldwide choose Megara as their all-in-one, flexible suite for collateral management, monetary policy, and post-trade processing in financial markets and securities services.

Megara provides cutting-edge, straight-through processing software for central banks, CCPs, CSDs, financial institutions, and custodians.

Designed for efficiency and flexibility, Megara supports seamless integration, multi-asset management, and up-to-date regulatory compliance.

Streamlined corporate actions

Automating corporate actions lets your business focus on value-driven activities: enhance efficiency, reduce operational risks, and ensure compliance.

Real-time connectivity

Takes advantage of native and real-time connectivity at the best world standards (Swift, ISO27001 etc.)

Optimized collateral usage

Ensure your firm meets regulatory demands yet maximizes asset efficiency: optimize your asset usage and mitigate counterparty risks with advanced collateral management features.

Reduced settlement risks

Improve liquidity management and financial outcomes: Enhance settlement processes across multiple markets to reduce trail failures and operational risks.

One hub architecture

Reduce costs and complexity covering complete lifecycle or select components such as: Settlement, Corporate Actions, Collateral Management, Accounting, Fees, Position Keeping, etc.

Multi-asset platform

Offers full custody services for both traditional and crypto assets by integrating Megara into the Digital Custody ecosystem.

Streamlined corporate actions

Automating corporate actions lets your business focus on value-driven activities: enhance efficiency, reduce operational risks, and ensure compliance.

Real-time connectivity

Takes advantage of native and real-time connectivity at the best world standards (Swift, ISO27001 etc.)

Optimized collateral usage

Ensure your firm meets regulatory demands yet maximizes asset efficiency: optimize your asset usage and mitigate counterparty risks with advanced collateral management features.

Reduced settlement risks

Improve liquidity management and financial outcomes: Enhance settlement processes across multiple markets to reduce trail failures and operational risks.

One hub architecture

Reduce costs and complexity covering complete lifecycle or select components such as: Settlement, Corporate Actions, Collateral Management, Accounting, Fees, Position Keeping, etc.

Multi-asset platform

Offers full custody services for both traditional and crypto assets by integrating Megara into the Digital Custody ecosystem.

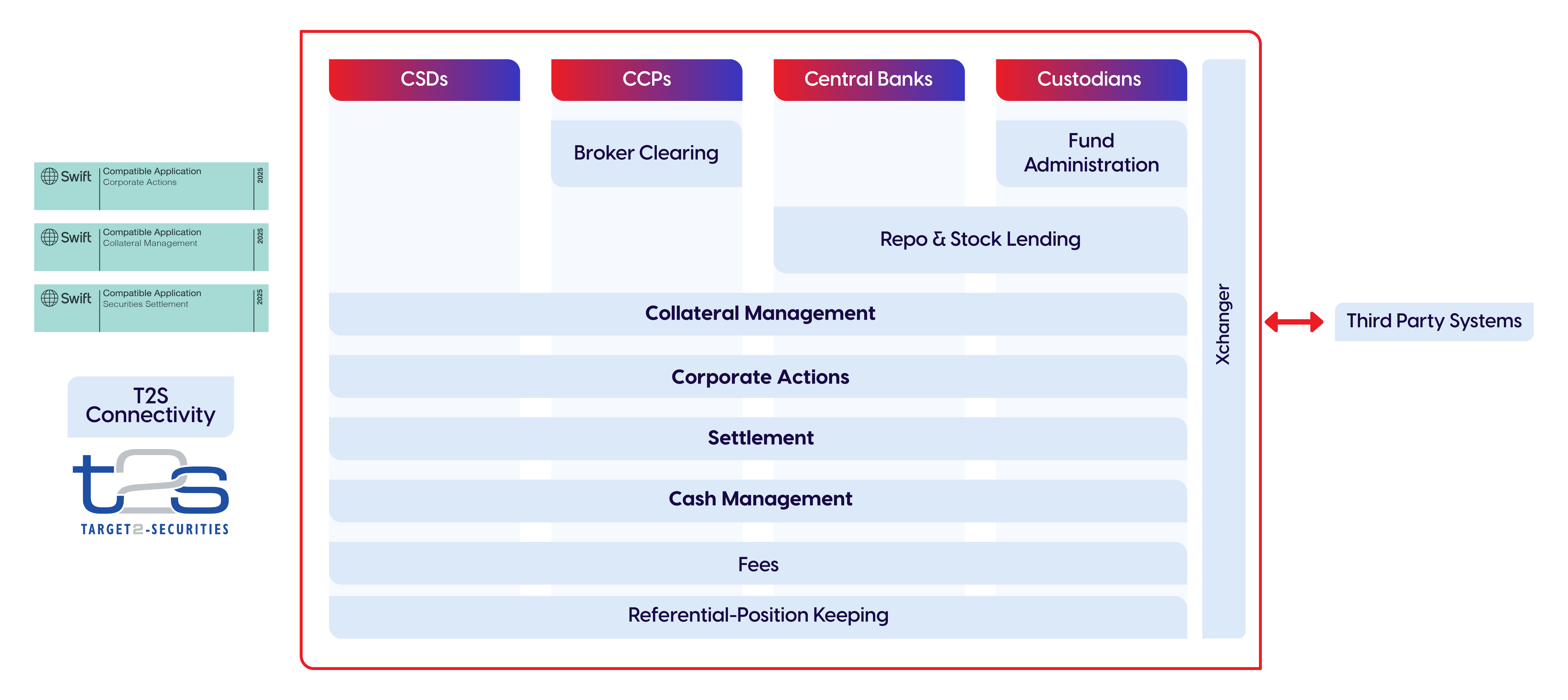

A flexible and modular suite designed for efficient post-trade processing.

Broker clearing

IDL

Fund administration

CRM

Repo and stock lending

Cash management

Collateral managment

Settlement

Corporate actions

Referential-position keeping

Cash management

Collateral managment

Settlement

Corporate actions

Referential-Position Keeping

Broker clearing

Repo & stock lending

Cash management

Collateral managment

Settlement

Corporate actions

Referential-position keeping

IDL

Repo and stock lending

Collateral managment

Settlement

Corporate actions

Referential-position keeping

Fund administration

Repo and stock lending

Cash management

Collateral managment

Settlement

Corporate actions

Referential-position keeping

Award-Winning Collaboration: Bank of Canada on Megara’s Value

“Vermeg ticked all the boxes in terms of the functionalities they have,” says Maksym Padalko, Adding that the firm also offered a “very cost-effective” service customised to the Canadian central bank’s needs.

“They offer a module structure where we could pick modules we want to use so we didn’t have to get the whole solution,” he says. “For example, we could install their product without using their back-office capabilities”

Maksym PADALKO

Adviser at the Bank of Canada’s financial markets department

IDClear Goes LIVE on Vermeg for CCP Collateral Management

“The successful implementation of Vermeg’s platform is a significant milestone for IDClear in supporting our business growth by providing strategic core technology infrastructure. This was a complex and challenging project, but thanks to the seamless collaboration between the Vermeg and IDClear project teams, it was executed expertly. The new Vermeg platform gives us business agility to achieve our goals and opens opportunities for further expansion, strengthening IDClear’s position as a market leader through cutting-edge technology. We look forward to continuing our partnership with Vermeg to deliver more innovative services to our members.”

Iding PARDI

President Director of IDClear

Data referential and position-keeping

Cash management

Settlement

Xchanger

Collateral management

Corporate actions

Fund administration

Download the comprehensive brochure of Vermeg’s award-winning post-trade processing solution.

Explore expert insights, industry perspectives and thought leadership. Discover how Vermeg’s technology supports institutions across Capital Markets and Insurance in navigating today’s evolving landscape.

The collateral technology of the future.

Robust solution to optimize and automate asset allocations.

Flow integration application for all formats of data, protocols and files.

Connect with our dedicated sales team for personalized offers that align with your unique needs and aspirations.

With over 30 years of expertise, we are dedicated to delivering exceptional client service whilst transforming financial operations through our innovative offerings in capital markets and insurance.

Subscribe to our newsletter

Capital Markets

Insurance

Solutions

About Us

Resources

Careers

Copyright ©2026 Vermeg GROUP B.V – All rights reserved.