Newsletter COLLINE Issue 10 | Q2 | 2022

Date

COLLINE is named “BEST SELL-SIDE COLLATERAL MANAGEMENT SOLUTION” by the FTF News Technology Innovation Awards 2022

We are excited to announce that VERMEG is the winner of the “BEST SELL-SIDE COLLATERAL MANAGEMENT SOLUTION” by the FTF News Technology Innovation Awards 2022.

This Award recognizes the accomplishments of a provider that has made great strides in helping sell-side financial institutions maximize their collateral management processes optimization via innovations in the IT systems supporting internal transformations and counterparty interactions.

The award was issued following an industry-wide vote and we are truly thankful for the vote of confidence for COLLINE. The win provides our team additional motivation to deliver planned improvements to satisfy UMR evolution and ensure collateral best-practices.

VERMEG FinTalk Podcast: Technology’s Role in the Future of Collateral Management with VERMEG’ Wassel Dammak

Collateral optimization is set to be a hot topic for the years to come, with a newfound focus on automation and efficiency. This makes the mastery of your systems and processes vital.

Wassel Dammak, Product Strategy Director at VERMEG, brings us a look into the tools and methods through which this can be achieved, bringing COLLINE, machine learning and artificial intelligence to the forefront of the conversation.

This podcast episode covers:

⁄ How collateral optimization can enable automation and efficiency by pledging the optimal collateral

⁄ Considerations around constraints, be they legal, operational, or business constraints

⁄ COLLINE’s Email Processor, and how machine learning/artificial intelligence can help streamline processes

⁄ Horizon scanning, and where technology will solve impending challenges

Email Processor selected by a large Buy side

It has been about a year now that we onboarded in COLLINE’s technical stack a digital and intelligent component that automates the treatment of emails still widely used in the Collateral Margining communication.

This Email Processor (EMP) retrieves emails from the Collateral Mail Inbox, detects the ask behind (Margin Call, Reply to the margin Call, interest reconciliation, etc.…) and launches automatically the appropriate workflow step in COLLINE without any human intervention.

The EMP is being rolled out at Sell Side and buy side clients globally.

How COLLINE can help in Collateral Management & Optimization

Collateral management is a sensitive function that is shared by Risk, Treasury, Front Office and Operations departments. It is closely scrutinized by Regulatory bodies globally and deemed as a systematic risk function.

For those reasons, the IT infrastructure supporting collateral management must be robust, proven, cost effective and evolutive to comply with regulation and support the business in offering collateral services.

COLLINE consolidates Collateral Management across business lines (OTC derivatives, cleared OTCs, Exchange Traded Derivative, Repo, SBL, TBAs, ETDs) in both Principal and Agency models:

⁄ It optimizes collateral mobilization to reduce related cost, manage liquidity and maximize the inventory utilization according to multiple objectives.

⁄ It packages and standardizes the connectivity to utilities and participants in the collateral life cycle.

⁄ It reduces IT costs by onboarding new technologies like DLTs and AI.

⁄ It supports the industry in the compliance with the regulatory framework evolution and the new ESG standards.

At VERMEG, we continue to invest steadily in COLLINE to help our clients and the industry achieve a resilient, cost effective and profit generator collateral framework.

The recent product enhancements extend the features coverage to more flexibility in the Eligible Collateral Schedules setup and integration, additional features in the Self-Service Portal and cross products margining capabilities for Agency business.

COLLINE Standalone Optimizer New features

One of the major challenges faced by financial institutions is to centralize their inventories and optimize asset allocations against margin requirements received from multiple trading desks. Front office teams look to minimize funding costs and make best use of available cash, securities and digital assets with flexible optimization algorithms to achieve different objectives and results (cost savings, liquidity preservation, etc…).

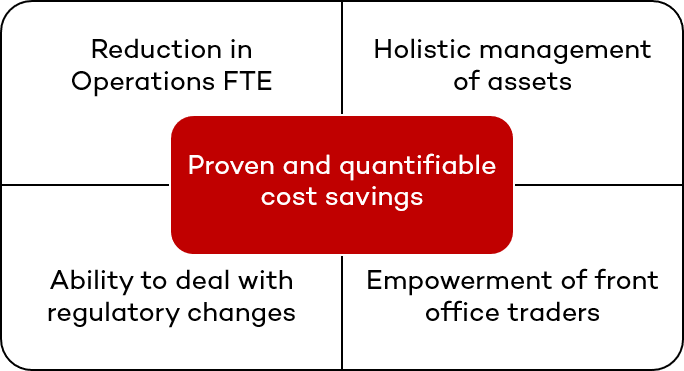

COLLINE Optimizer is a ‘component’ that integrates seamlessly with existing treasury and collateral management systems, it is a robust cloud or on-premises solution that helps to achieve multiple objectives:

⁄Reduction in Operations FTE for collateral allocation

⁄ Holistic management of assets across multiple business units

⁄ Ability to deal with regulatory changes through the usage of COLLINE eligibility matrix

⁄ Proven and quantifiable cost savings

⁄ Empowerment of front office traders to make better business decisions

Collateral Optimization as a service is also offered by COLLINE Optimizer allowing Assets & Collateral Servicers and Sell side banks to extend their offer to their final clients, especially with the extensive usage of securities assets to meet regulatory IM requirements and a new environment of rising interest rates.

Recent enhancements in the COLLINE optimizer cover the openness of the optimization constraints to operational ones, allowing to customize the optimization algorithm to take into consideration both legal (Eligibility, Concentration Limits, Haircuts) and user specific ones (Min Nominal, max percentage, etc…).

Acadia Connectivity extension

COLLINE provides a packaged connector to multiple market infrastructures. Connectivity. The Acadia API has been extended to reconcile interest calculation and payments. Work is also in progress to adapt the API to the new Substitution Workflow. Those features will allow clients to achieve higher STP rates and reduce manual work and operational frictions. .

Cross product margining capabilities

COLLINE is uniquely capable of consolidating collateral management, inventory and optimization across asset classes and business lines: Bilateral OTC derivatives, Cleared OTC derivatives, Exchange Traded Derivatives, Repos, Stock Loan and Borrow. Underlying assets are cash, securities and digital assets.

COLLINE is also used as a solution for both Principal and Agency businesses opening the door to opportunities for margining across products in both the margin messaging and payment.