The European capital markets are on the brink of a major transformation: the shift from a T+2 to a T+1 settlement cycle. This change, proposed by the European Securities and Markets Authority (ESMA) and targeted for implementation by 11 October 2027, represents more than a regulatory deadline. It is a strategic leap towards faster, safer, and more efficient post-trade operations across Europe’s diverse financial ecosystem.

At the heart of this evolution, Vermeg’s Megara platform is emerging as a pioneering solution that helps financial institutions seamlessly navigate the complexities of T+1, preparing them not only for compliance but to lead in a rapidly digitizing market.

/ Understanding the Regulatory Drive Behind the T+1 Shift

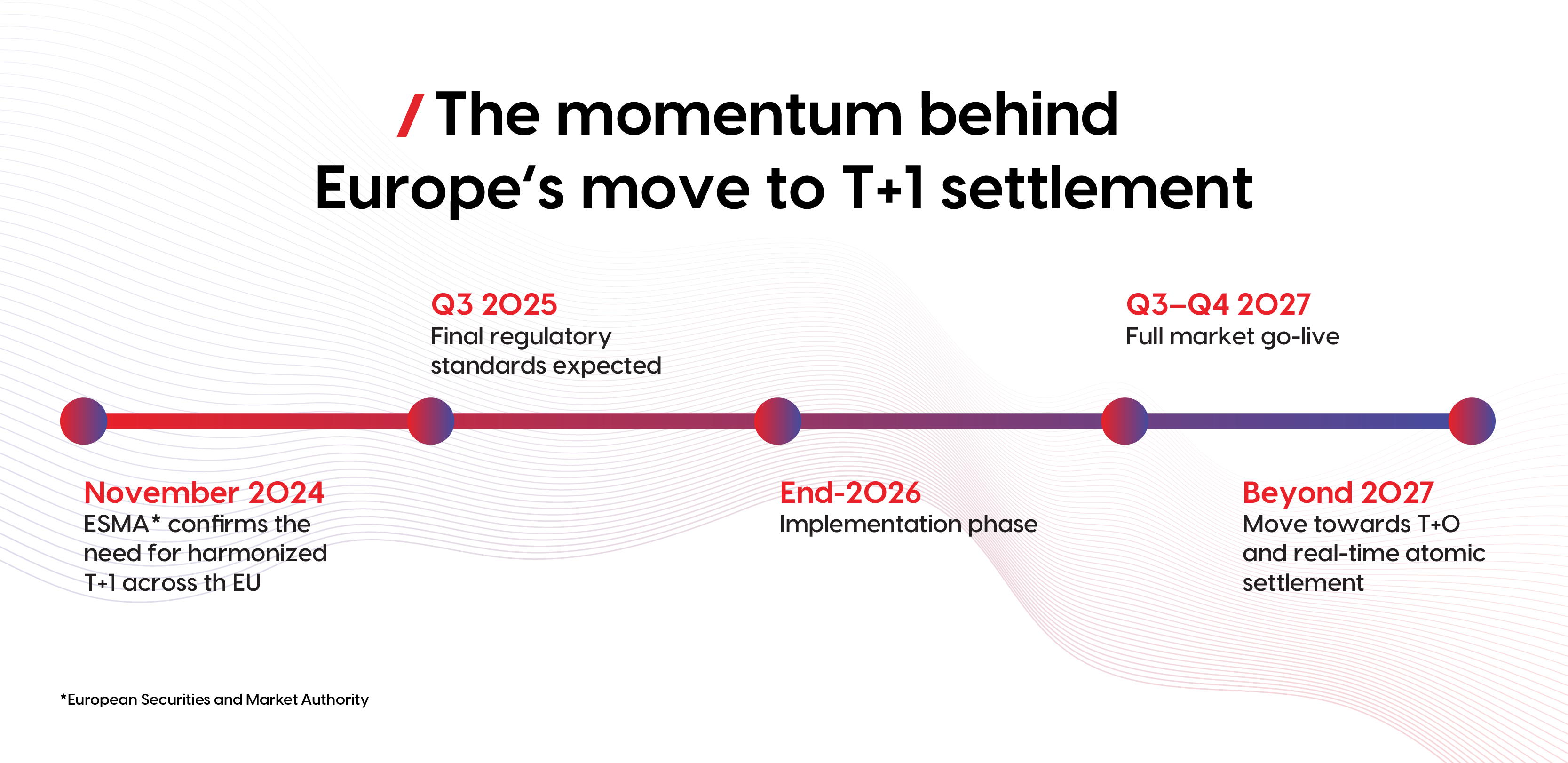

ESMA’s November 2024 assessment reaffirmed the urgency of harmonizing the settlement cycle across the European Union to T+1. This move aligns Europe with recent transitions in the U.S. and Canada, as well as upcoming changes in the UK and Switzerland, aiming to reduce counterparty risk, enhance market resilience, and harmonize with global liquidity standards.

The proposed go-live date balances the readiness of market infrastructure with risk mitigation strategies. ESMA’s roadmap calls for final regulatory standards by Q3 2025, providing clear guidance and timelines for all stakeholders. Importantly, this shift is a steppingstone towards even faster settlements—eventually enabling T+0 processing and innovations like distributed ledger technology (DLT) and tokenized assets.

/ Navigating Europe’s Complex and Fragmented Financial Infrastructure

Europe’s financial market landscape is uniquely fragmented, comprising over 30 trading venues, numerous Central Securities Depositories (CSDs), Central Counterparties (CCPs), and multiple currencies. This complexity makes compressing the settlement cycle into a single day particularly challenging.

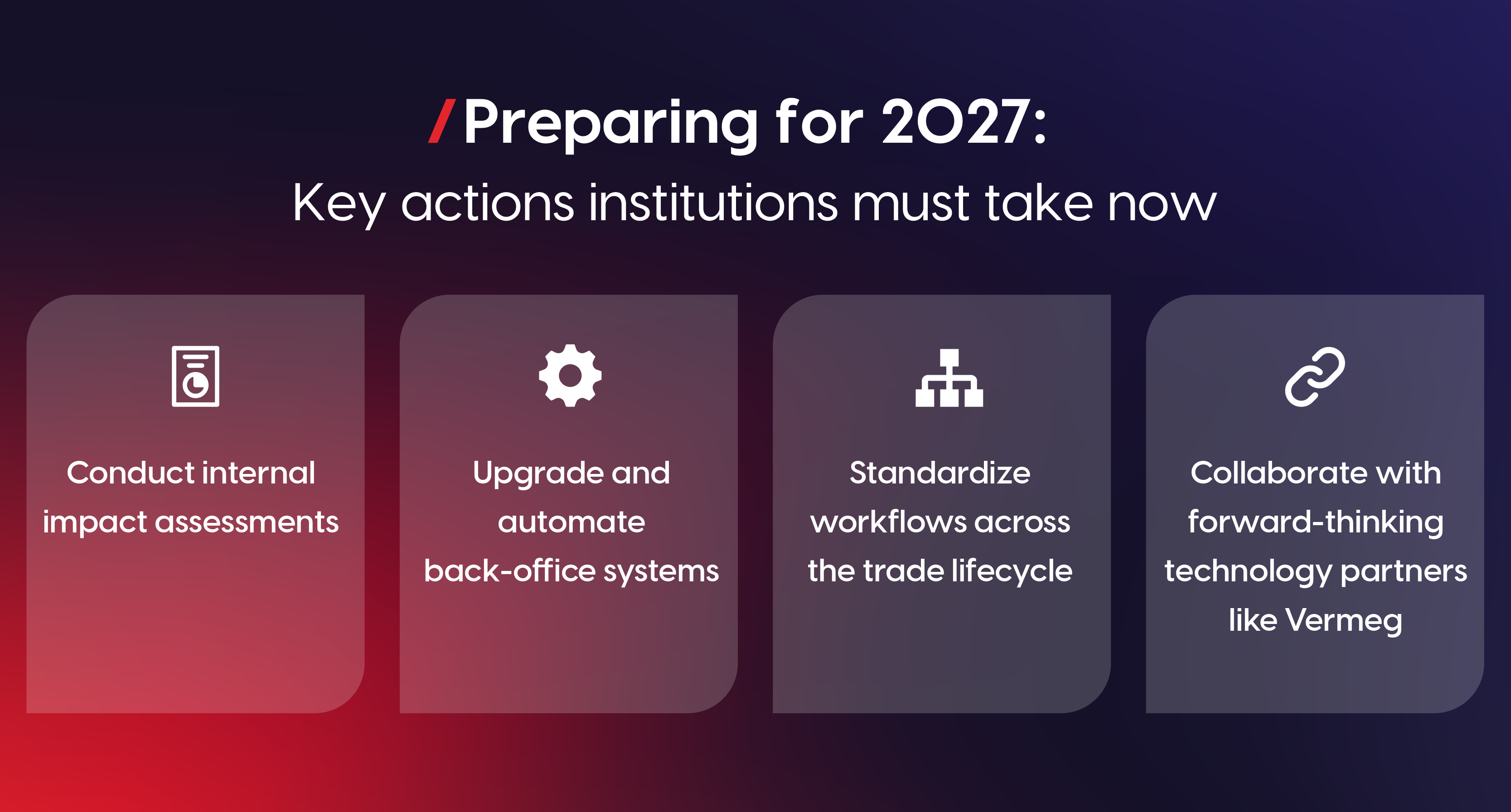

Synchronizing trade execution, clearing, and settlement across disparate systems and regulations demands robust technological solutions. Legacy platforms and manual workflows present significant risks to achieving T+1 goals. Institutions must accelerate investments in automation, real-time data processing, and standardized workflows to meet the compressed timelines without disrupting market stability.

/ Lessons Learned from the US and UK: Why Automation is Essential?

The U.S. successfully transitioned to T+1 in May 2024, achieving a 42% reduction in CCP margin requirements and fewer settlement fails. However, the experience also highlighted vulnerabilities in systems still relying on manual processes.

The UK has proactively developed its T+1 Code of Conduct, emphasizing twelve operational actions and five behavioral expectations designed to promote automation, straight-through processing (STP), and efficient corporate action management. These lessons underline that human intervention alone cannot sustain T+1 operations; automation is indispensable.

/ How Vermeg’s Megara Suite is revolutionizing Post-Trade Processing

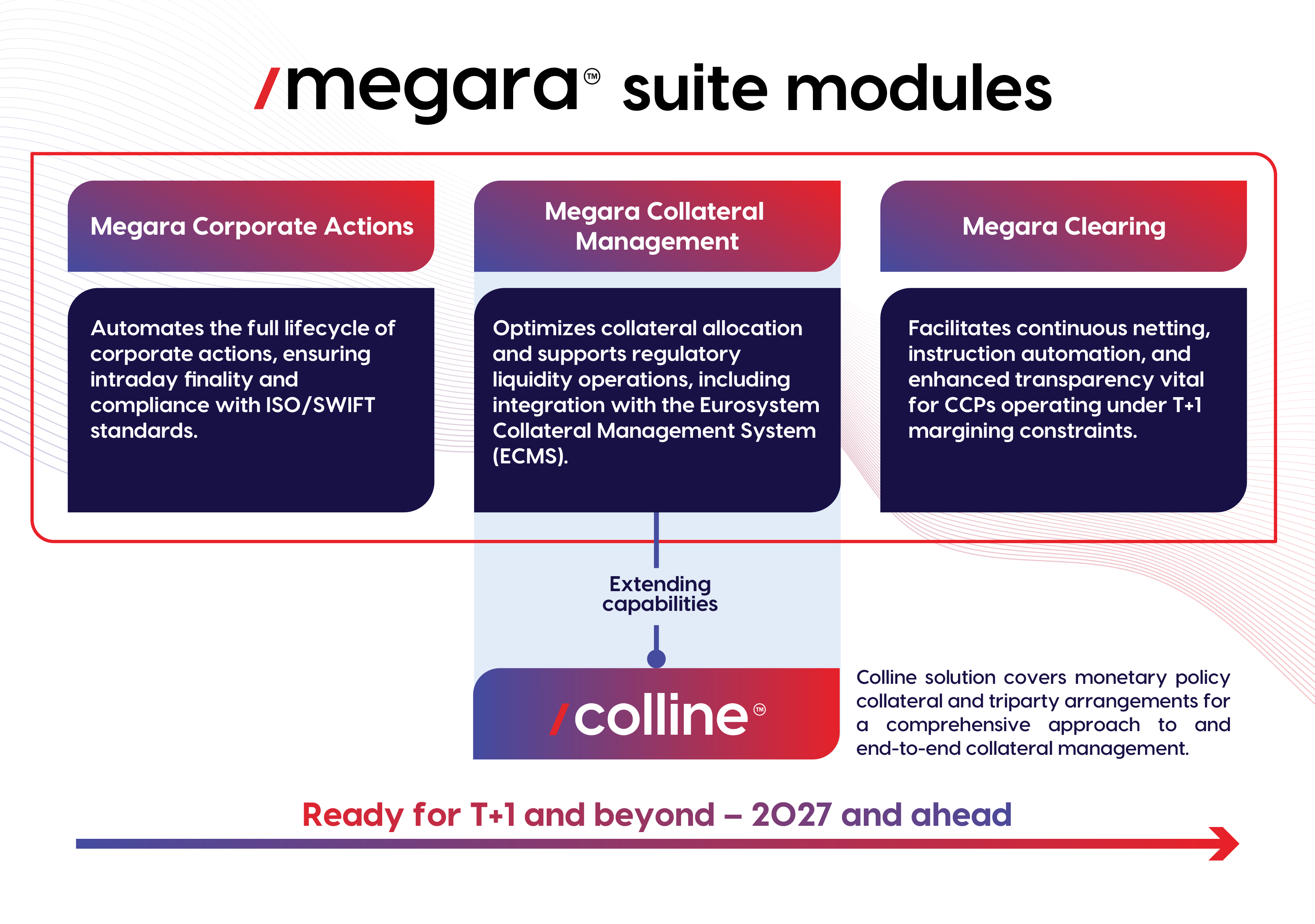

Vermeg’s award-winning Megara platform is uniquely designed to meet the operational demands of T+1 and beyond. Its modular architecture supports real-time processing, end-to-end automation, and seamless integration with CSDs, CCPs, and other market participants.

By partnering closely with clients through Proof-of-Concepts, Vermeg ensures tailored deployments that accelerate readiness well ahead of the 2027 deadline.

/ Preparing for 2027: Turning Compliance into Competitive Advantage

While T+1 presents undeniable operational challenges, it also offers early adopters strategic benefits: reduced credit and liquidity risk, improved capital efficiency, and alignment with global market infrastructure standards.

Moreover, firms are encouraged to rehearse T+0 processes internally, laying the groundwork for future innovations in real-time settlement.

/ The Future of Settlement: From T+1 to Real-Time Post-Trade Innovation

T+1 is not the final destination but a critical milestone toward instant settlement and next-generation market infrastructure. Technologies such as blockchain, tokenization, and AI-driven analytics promise to revolutionize capital markets, making settlements more transparent, secure, and efficient.

Vermeg is at the forefront of these developments, continually enhancing the Megara platform to support these innovations and keep clients ahead in an evolving landscape.

/ Assess Your Readiness for T+1 with Vermeg's Expert Solutions

The transition to T+1 calls for proactive modernization and strategic investment. Megara suite offers the robust automation, flexibility, and integration capabilities needed to not only comply but thrive in the new post-trade era.

Reach out to Vermeg’s experts today to evaluate your institution’s readiness and explore how Megara can accelerate your T+1 transformation journey.

Contact:

Pierre-Nicolas BISSONNET

Deputy Director, Banking Market Strategy

Email: pnbissonnet@vermeg.com

Mehdi NEGRA

Product Deputy Director, Banking Market Strategy

Email: mnegra@vermeg.com